Shares are complicated to understand for those who have not yet learnt about them. One of the most fundamental ratios which investors look at is a share’s dividend yield. In this article, we’ll explain what a dividend yield is and how it is calculated.

What are Shares?

Put simply, a share or stock is part ownership in a company. Buying a stock entitles the buyer to that proportion of a company’s assets and earnings. For example, if you bought 1 share in a company and the company had 100 shares you would theoretically be entitled to 1% of the company’s earnings and assets.

Companies issue shares as a way of funding their business activities. By issuing shares a company has access to more money. Subsequently, it will be better able to expand. Conversely, shareholders purchase shares as a form of investment. Shareholders can make money by either selling their shares for more money than they bought them for or receiving a dividend.

What is a Dividend?

A dividend is the second way a shareholder makes money from its shares. A dividend is a sum of money that a company pays to its shareholder out of its profits. Generally, dividends are paid annually or bi-annually and are proportionate to the number of shares a person holds.

For example, a person might hold 1000 shares in Company A. After announcing its profit at the end of a financial year the company might pay out $0.20 per share. This would see Company A pay the shareholder $200 as a dividend payment.

What is a Dividend Yield?

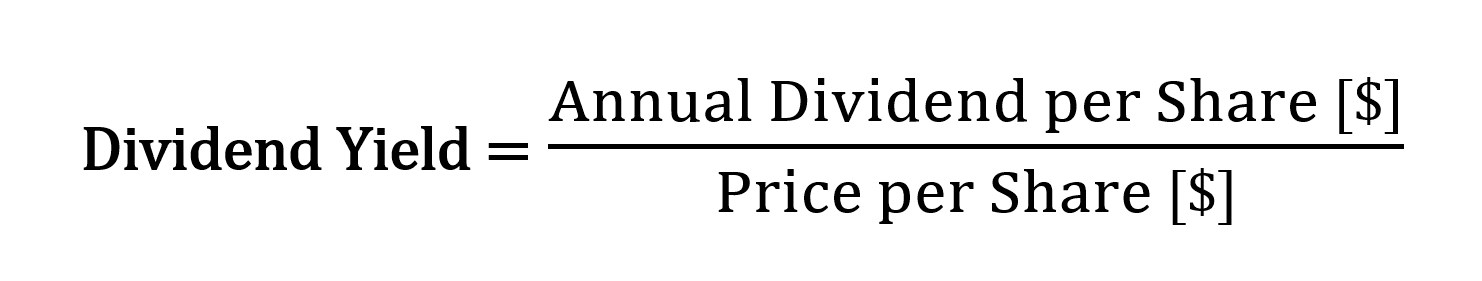

A dividend yield is a ratio that indicates what percentage of the share value an investor can expect to receive as a dividend each year. It is usually represented as a percentage and is calculated using the below formula.

Use of this formula will produce a percentage which is a share’s dividend yield. For example, if a share’s dividend yield is 5% an investor will receive a $5.00 annual dividend payment if they purchased a $100 share. Knowing a share’s dividend yield is important in comparing shares. It will assist with deciding which share you would like to buy and at what price.

Summary

In summary, a share’s dividend yield is a ratio which indicates how much of a share’s value you can expect to receive each year as a dividend. It is usually expressed as a percentage and will vary from share to share.

Additionally, it is important to remember that some shares pay very small or no dividend so that they can reinvest their profits in the business. Therefore, it is important to be aware of what dividend you can expect upon buying a share. Should you need further advice on the tax implications of share trading or on how to issue shares it is best to seek professional advice.