The Contractor Agreement (Individual) allows you to hire a contractor that is an individual (ie. not a company).

Laws and regulations are continually evolving, and failure to comply can result in severe consequences for businesses. Our contractor agreement is constantly updated by legal professionals to ensure it stays up-to-date with the latest regulations in Australia.

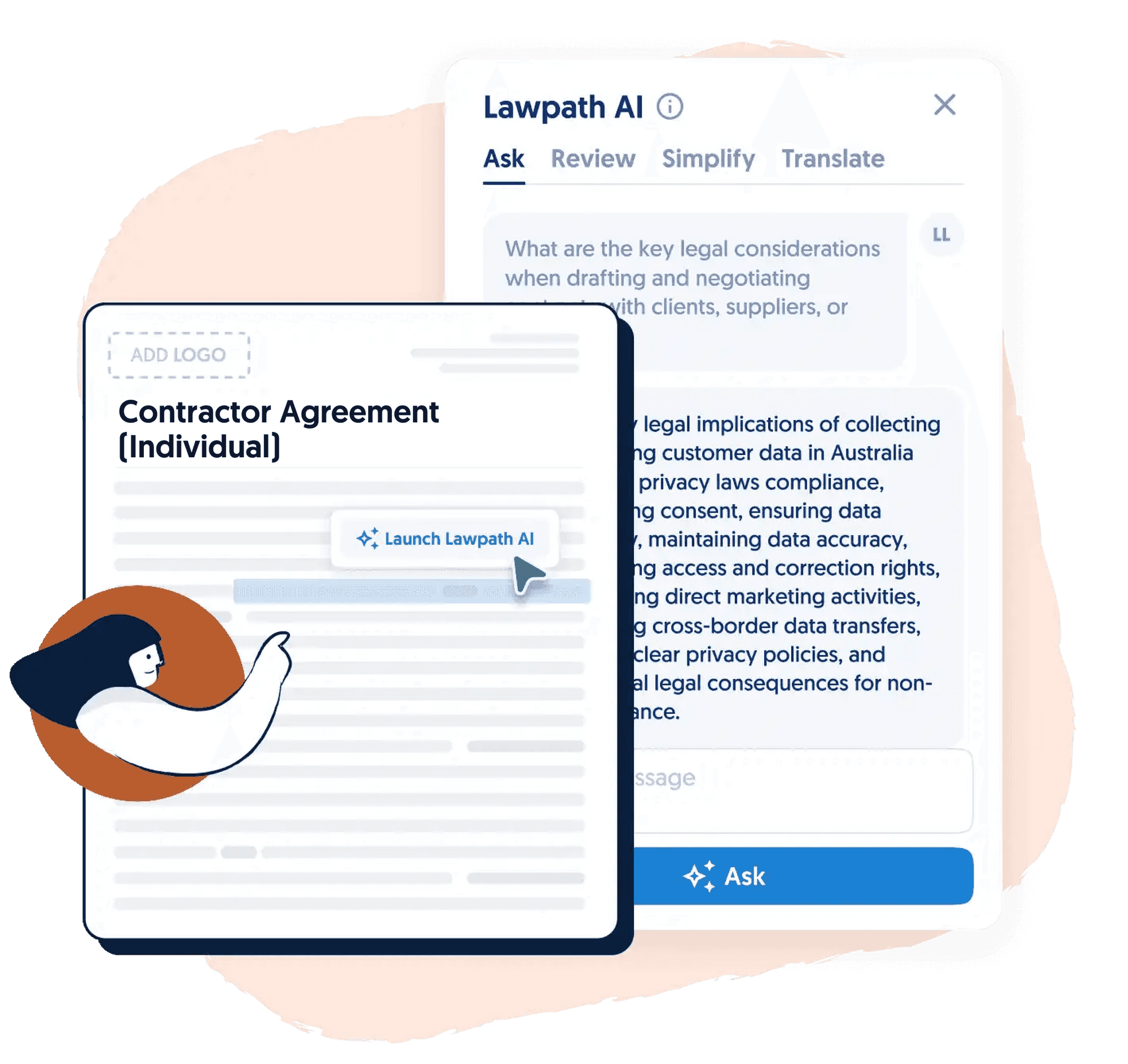

Leveraging advanced Al technology and guided questionnaires, we ensure the contractor agreement is customised to meet the unique needs and specific requirements of your business.

With a few clicks and by answering a guided questionnaire, we incorporate your responses into a professionally drafted contractor agreement in under 5 minutes.

Set up a free account

Search and find the document you need from our list

Follow the prompts and fill in all the relevant details

View and share your ready to use legal document

The key distinction between an individual contractor and an employee lies in their employment relationship. An individual contractor is typically engaged for specific projects or tasks and works independently, often with their equipment and resources. They are responsible for their taxes and may not receive employee benefits. Conversely, an employee is typically hired for an ongoing role, receives benefits, works under the employer’s direct supervision, and has taxes withheld from their wages.

A6: Absolutely! Our Individual Contractor Agreement is designed to be flexible and adaptable to your specific needs. You can easily modify the agreement to include any additional terms, conditions, or requirements that pertain to your engagement with the individual contractor.

In the event of a breach of the Individual Contractor Agreement, the agreement outlines the rights and remedies available to the affected party. These can include obtaining an injunction to prevent the release of confidential information, seeking monetary compensation (damages) for any losses incurred due to the breach, or pursuing other legal remedies as specified in the agreement.

The Individual Contractor Agreement does not necessarily impose a specific timeframe. It is recommended that the agreement does not include a specific duration, and confidentiality obligations should remain in effect until the information is no longer considered confidential or enters the public domain. However, if both parties agree on a time limit, it should be reasonable and aligned with the legitimate interests of your business.

The enforceability of the Individual Contractor Agreement depends on the jurisdiction specified in the agreement. This document is governed by the laws of the country or state where it is executed. If you need to take legal action to enforce the agreement or address breaches, it must typically occur in the state or territory court where the agreement was executed.

While the Individual Contractor Agreement is primarily used for engagements with individual contractors, several other parties can benefit from signing similar agreements. These include clients engaging with sensitive information, vendors with access to confidential data, independent contractors needing to safeguard their rights, and investors involved in the exchange of commercially sensitive information.hy, web development, and more.

Sign up to a free Lawpath account!

Our experienced lawyers are here to help.

Solutions

Copyright Lawpath Operations Pty Ltd ABN 74 163 055 954. Lawpath is an online legal service that makes it faster and easier for businesses to access legal solutions solely based on their own preferences. Information, documents and any other material featured on the Lawpath website, blog or platform is general in nature. You should always seek advice from a qualified professional to check if Lawpath's materials or services meet your particular circumstances. You can access in-house and 3rd party qualified professionals through certain products sold by Lawpath. Use of Lawpath and lawpath.com.au is subject to our Terms and Conditions and Privacy Policy.

Lawpath Operations Pty Ltd (ACN 163 055 954) ("Lawpath") is a corporate Authorised Representative (number 1316602) of Amplus Global Pty Ltd (ACN 162 631 325), the holder of Australian Financial Services Licence number 505929. Any financial product advice provided in this website is general in nature. Content on this website does not take into account the objectives, financial situation or needs of any person, and as such, you should consider the appropriateness of the advice having regard to your own objectives, financial situation and needs. Where necessary, you should obtain a Product Disclosure Statement relating to the product and consider it before making any decision about whether to acquire the product. Lawpath believes the information contained in this website is correct. All information, opinions, conclusions, estimates or recommendations provided are included with due care to its accuracy; however, no representation or warranty is made as to their accuracy, completeness, or reliability.