Lawpath Legal combines AI that works around the clock with experienced Australian lawyers who step in when it matters. Fixed-price legal for small business - no billable-hour surprises.

Traditional law firms

Lawpath Legal

Employment contracts, service agreements, NDAs, terms of service, partnership deeds - drafted by AI and reviewed by lawyers.

Award compliance, unfair dismissal, contractor agreements, workplace policies, and HR documentation aligned with Fair Work.

Company registration, ABN, trust structures, shareholder agreements, and constitution documents to get your entity set up right.

ASIC annual reviews, privacy policies, board minutes, regulatory reporting, and ongoing compliance monitoring powered by Atlas.

Trademark registration and monitoring, copyright advice, IP strategy, licensing agreements, and brand protection across Australia.

Website terms, privacy policies, consumer guarantees, digital marketplace compliance, and ACCC regulatory requirements.

Senior Lawyer

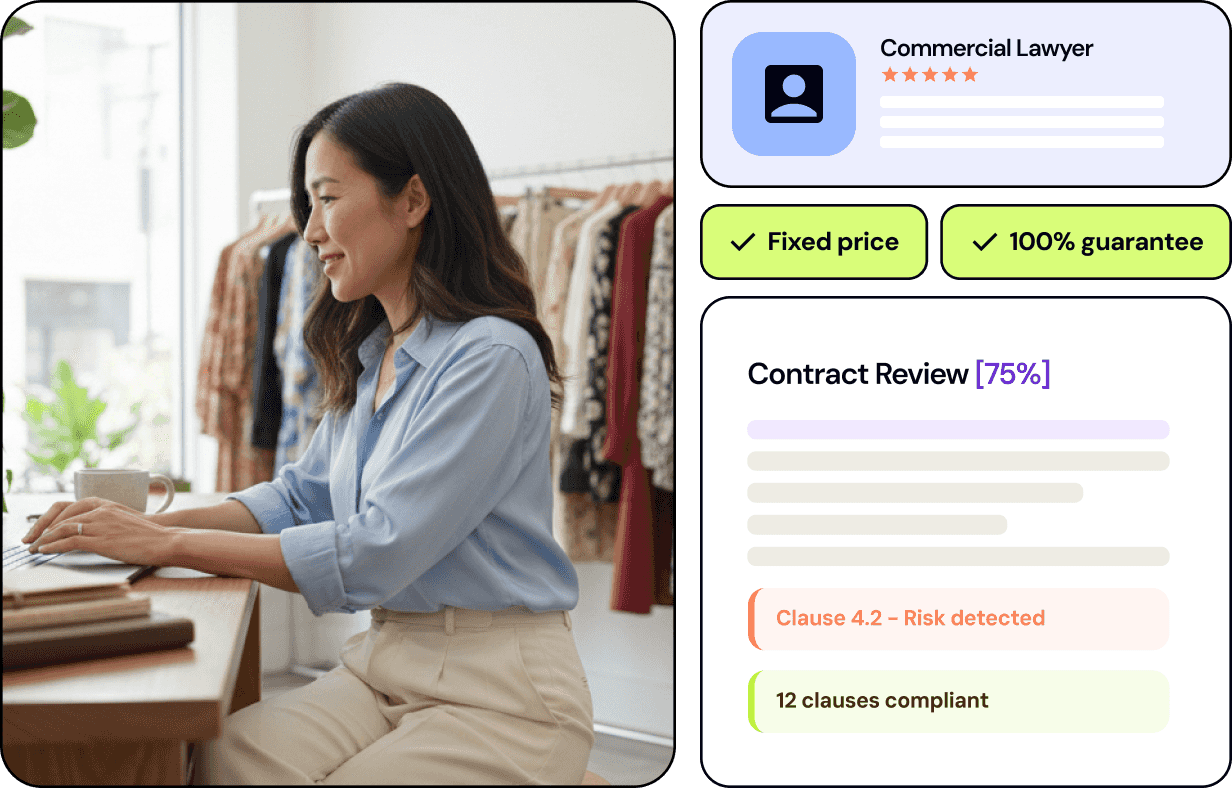

Analyses contracts clause-by-clause against Australian law and industry benchmarks. Flags risky terms, missing protections and non-standard language before a lawyer reviews.

Analyses in minutes

Monitors Fair Work awards, minimum wage changes, penalty rate updates and modern award variations. Alerts you when your employment contracts or pay rates need updating.

Real-time monitoring

Watches IP Australia for conflicting trade mark applications, monitors your brand across registries, and flags potential infringements before they become disputes.

Brand protection 24/7

Tracks ASIC deadlines, annual review dates, licence renewals and regulatory filings. Auto-creates compliance tasks and alerts your lawyer when lodgements are due.

Never miss a deadline

Generates first drafts of contracts, policies and legal documents using your business context, industry data and current legislation. Your lawyer then refines and finalises.

First drafts in minutes

Scans federal and state legislation changes, regulatory updates, and new case law that could affect your business. Surfaces what matters and filters out the noise.

Tracks all jurisdictions

Monitors ATO obligations, BAS lodgement dates, and tax deadlines. Pre-builds checklists, flags missed deductions, and surfaces cashflow risks before they become ATO problems.

ATO deadline tracking

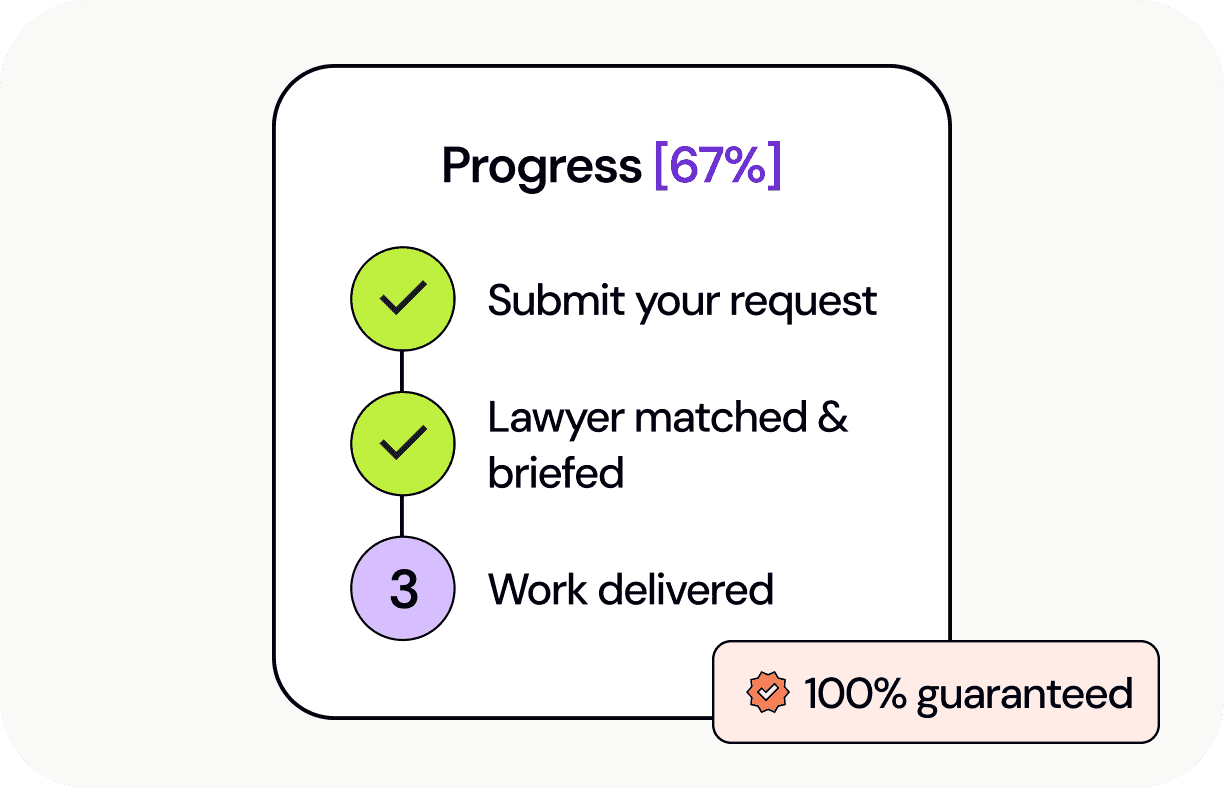

Gathers your legal question, business context and relevant documents before matching you with the right lawyer. Pre-compiles a full brief so your lawyer hits the ground running.

Instant triage

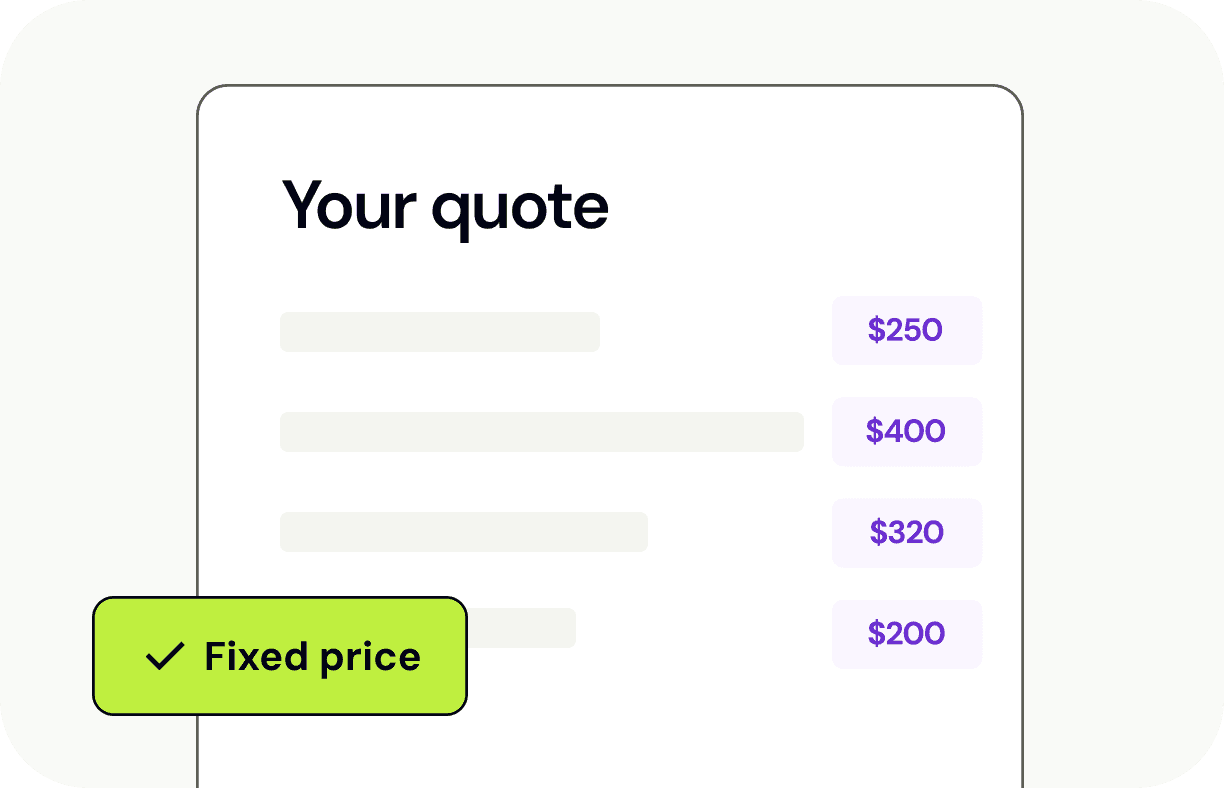

Every engagement comes with a fixed-price quote before work begins. No hourly rates ticking in the background, no unexpected invoices at the end of the month. You know exactly what you're paying before your lawyer writes a single word.

Every lawyer at Lawpath Legal holds a current practising certificate and specialises in commercial law for growing businesses. They've seen it all - from day-one startups to established companies scaling nationally. You're not their first small business client; you're their thousandth.

Forget booking consultations weeks in advance or chasing your lawyer for updates. Lawpath Legal is designed for speed - speak to a lawyer within 48 hours, get documents turned around in days not weeks, and manage everything from one simple online platform.