Lawpath Legal provides quality, fixed price legal help to all Australian businesses.

Lawpath Legal is the partner law firm attached to the Lawpath technology platform. Powered by our award winning technology, Lawpath Legal provides fixed price legal services to small businesses. We believe every business should have access to the legal protection they deserve. We make this possible by offering online, innovative and transparent legal services at a fraction of the cost and time of the traditional legal system.

General Commercial

Contract Drafting/Review

Trademark

Patent

Employment

Startups/New Businesses

Property And Conveyancing

Personal

Disputes/Litigation

Sale Of Businesses

Franchising

Other

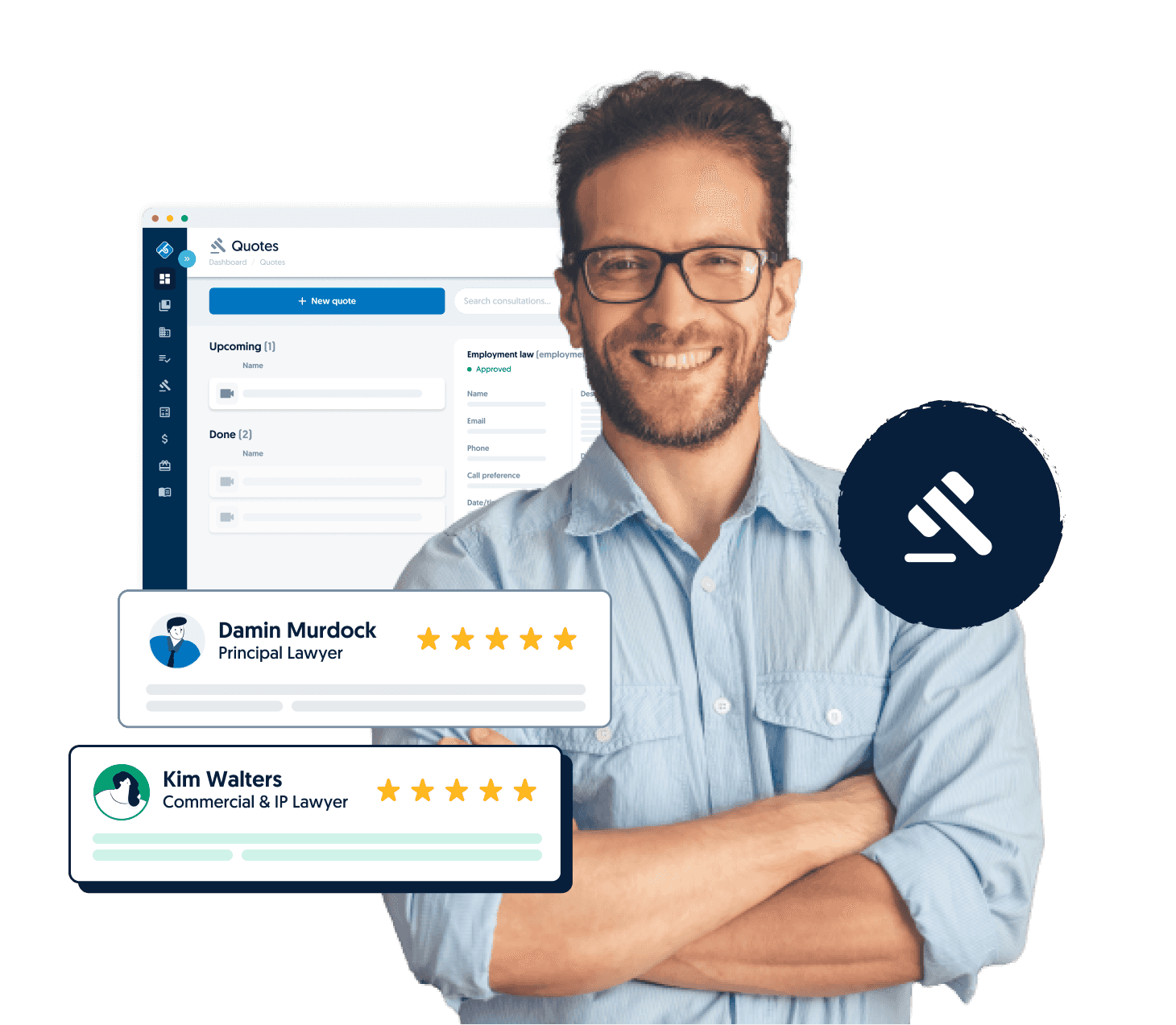

Communicating with your lawyer doesn’t have to be difficult. On our online portal, your queries will immediately be visible to our service staff and prioritised within our system, so you can ensure that your legal needs are met in a responsive, hassle-free and sensitive manner.

Our lawyers have extensive backgrounds in various areas of commercial practice. They cater for issues both simple and complex, providing practical solutions tailored to the needs of your business.

Hidden costs are a thing of the past with Lawpath. We pride ourselves on an uncomplicated and affordable pricing structure. Fixed, upfront, and transparent, our goal is to make legal advice and representation accessible for individuals and businesses of all sizes.

We help customers not only to minimise legal risk, but also to thrive across every aspect of their business, by leveraging industry insights from our extensive client base, and from algorithms trained on our extensive database.

Head of Legal

Commercial & Start Up Lawyer

Business & Commercial Lawyer

Senior Lawyer & Public Notary

Business & Commercial Lawyer

Senior Lawyer

Senior Lawyer

Business & Commercial Lawyer

Business & Commercial Lawyer

Business & Commercial Lawyer

Commercial Lawyer

Commercial Lawyer

Principal Lawyer

Solutions

Copyright Lawpath Operations Pty Ltd ABN 74 163 055 954. Lawpath is an online legal service that makes it faster and easier for businesses to access legal solutions solely based on their own preferences. Information, documents and any other material featured on the Lawpath website, blog or platform is general in nature. You should always seek advice from a qualified professional to check if Lawpath's materials or services meet your particular circumstances. You can access in-house and 3rd party qualified professionals through certain products sold by Lawpath. Use of Lawpath and lawpath.com.au is subject to our Terms and Conditions and Privacy Policy.

Lawpath Operations Pty Ltd (ACN 163 055 954) ("Lawpath") is a corporate Authorised Representative (number 1316602) of Amplus Global Pty Ltd (ACN 162 631 325), the holder of Australian Financial Services Licence number 505929. Any financial product advice provided in this website is general in nature. Content on this website does not take into account the objectives, financial situation or needs of any person, and as such, you should consider the appropriateness of the advice having regard to your own objectives, financial situation and needs. Where necessary, you should obtain a Product Disclosure Statement relating to the product and consider it before making any decision about whether to acquire the product. Lawpath believes the information contained in this website is correct. All information, opinions, conclusions, estimates or recommendations provided are included with due care to its accuracy; however, no representation or warranty is made as to their accuracy, completeness, or reliability.