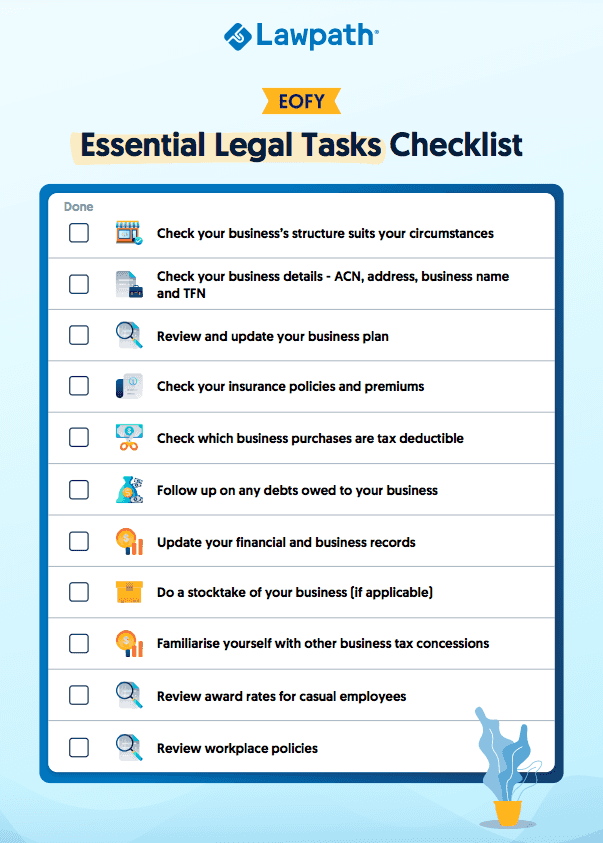

Not sure what you need to do in order to prepare your business for the end of financial year? Our legal checklist provides a simple way you can ensure you’ve taken care of all your pressing legal obligations including:

- Updating your business details

- Understanding your tax obligations and deductions

- Reviewing your business structure and business plan

- Recovering money owed to your business