Dominic is the CEO of Lawpath, dedicating his days to making legal easier, faster and more accessible to businesses. Dominic is a recognised thought-leader in Australian legal disruption, and was recognised as a winner of the Australian Legal Innovation Index and recently a winner of the LexisNexis 40 Under 40 (APAC).

If you have a new and flourishing business, you cannot go without a cap table. A cap table, or capital table, is an Excel spreadsheet that outlines who owns what in a company. It lists all shareholders, their portion of ownership and the securities distributed.

Why do I need a cap table

1. Managing money

A cap table tracks incoming and outgoing ownership, and terms of ownership. It therefore has the potential to become very complicated very quickly.

In particular, splitting the ‘pie’ of the business is not an easy task. As investors join, you must consider the changes in percentage of ownership and the changes in the nature of ownership.

If you one day decide to sell the company, you may also need to produce the cap table to identify the owners and the value of your part.

2. Raising money

Investors will need to know about the company structure to assess whether investing in your company is desirable. The cap table shows investors what proportion of the business they own, how much their shares are worth and gives an overview of the financial structure that will ultimately determine the value of their investment.

As the business owner, it will also allow you to assess the impact of new investments on the value of the business to decide on future issues of securities.

3. Complying with tax regulation

How does it work?

You may be thinking that your situation is different, that your business structure is too simple, at this stage, to need a cap table. Consider the following situation and how small changes can rapidly complicate a business’ financial structure.

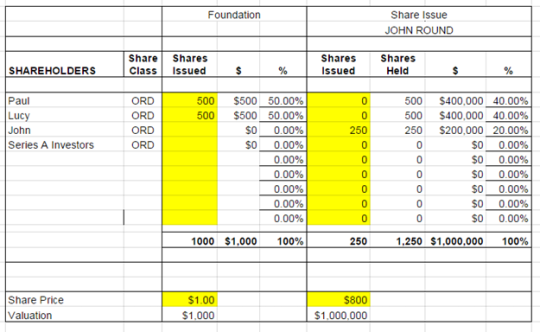

First year

Paul and Lucy start a restaurant in Sydney.

Paul, founder, 50%, $500

Lucy, founder, 50%, $500

Total company, 100%, $1000

Second year

Observing the restaurant’s success, John makes an offer for $200 000 for 20% of the restaurant.

Paul, founder, 40%, $400 000

Lucy, founder, 40%, $400 000

John, investor, 20%, $200 000

Total company, 100%, $1 000 000

Here is an example of what the company table can look like.

You may also want to use the following cap table template. To edit, sign in to your Google account and select File > Make a Copy.