Dominic is the CEO of Lawpath, dedicating his days to making legal easier, faster and more accessible to businesses. Dominic is a recognised thought-leader in Australian legal disruption, and was recognised as a winner of the Australian Legal Innovation Index and recently a winner of the LexisNexis 40 Under 40 (APAC).

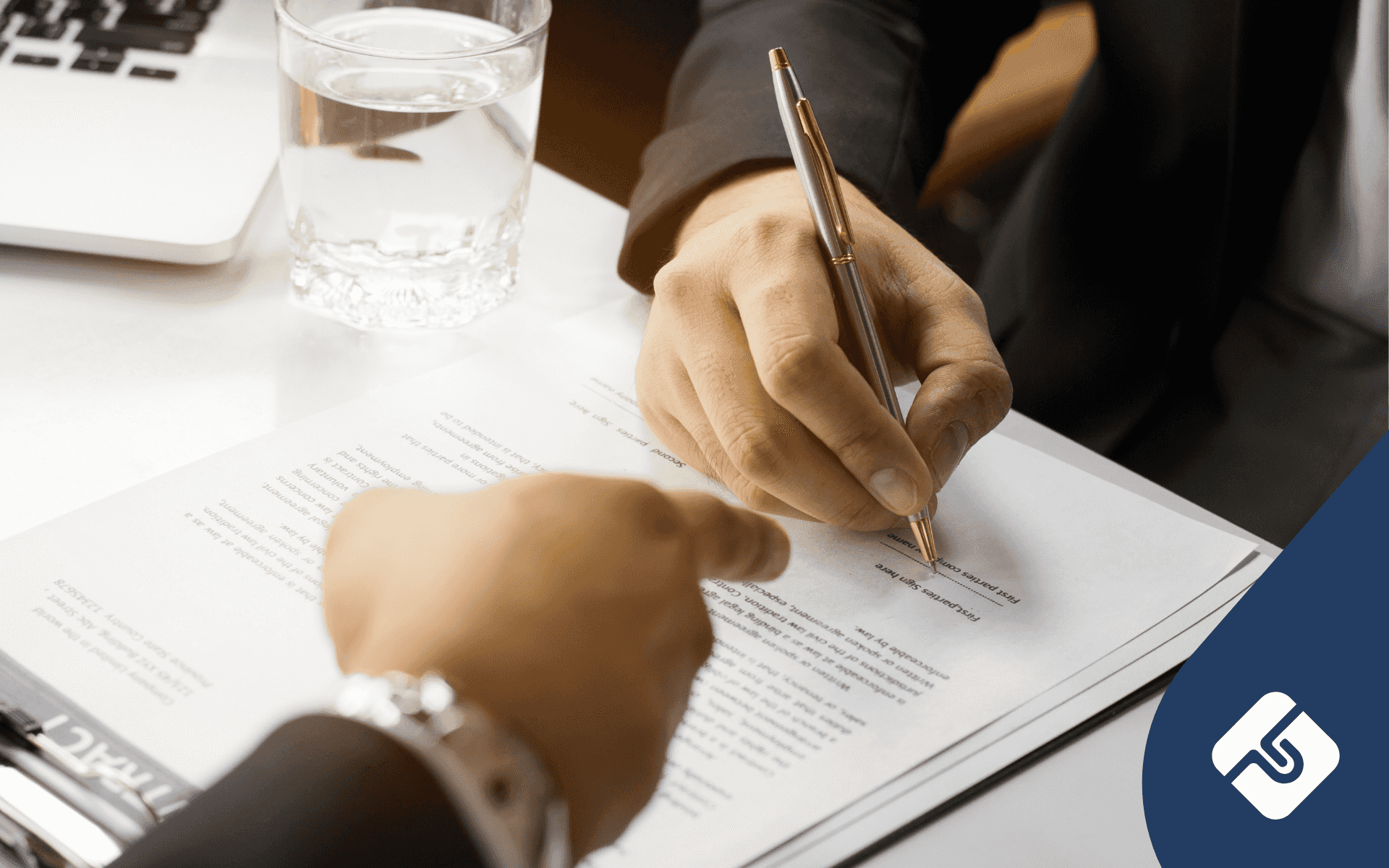

When you start a business partnership, there are many terms of your venture that should be ironed out. This can include terms relating to sharing profits, duties of the partners, and dissolving the partnership. Where you and your new found business partner might agree terms at a high level, you might disagree on details should one party chose to walk away or take an action that isn’t in the spirit of the agreement. Both parties are much better positioned for success when the contract reflects the intent of the agreement. This should result in a fair and reasonable outcome should it end. The best way to clarify your terms from the beginning is to have a Partnership Agreement in place. In this article, we’ll outline how you can create a Partnership Agreement and commence your venture with the proper protections in place.

Key points

- Your Partnership Agreement will include all the terms of your business partnership

- You should consider the duration, tax implications, termination, and negotiation terms of your agreement

- You can create a Partnership Agreement in a matter of minutes online

Duration and renewal options

You can specify when you Create A Partnership Agreement how long you want it to last for. For example, is it a one year term and the contract ceases or do you want a first right to renew the agreement before it expires? If so how long will you need to determine the renewal rights? Will your business partner be dealing exclusively with you (not your competitor) during the term of the agreement? If you’ve invested a great deal of time and effort into the partnership, would you want the other party to be able to speak with your competitor before the end of the term or your agreement? Clarifying what you and your partner/s want is crucial, and will ensure that you can either keep a good venture going or walk away.

Protecting your business

What if the deal goes bad?

If you’ve spent considerable expense entering into the arrangement, you may also want to ensure you can leave with your funds still intact. Here it’s wise to build in a lengthy exit clause to ensure you can recoup your investment. Alternatively, if the other party is damaging your brand and/or reputation, then can you terminate your agreement quickly? Is your business protected in the scenario where your business becomes liable? Will your brand and intellectual property be protected and what rights does the other party have to use your brand during the agreement and/or cease use on termination?

Tax implications

If any ‘contra’ goods and services are being exchanged within the benefits of the agreement, there may be GST implications. It’s a good idea to ensure a lawyer reviews agreements of this nature. No one likes a visit from the ATO years later auditing your business and seeking GST back-payments.

Negotiation

It’s always best to have clear terms agreed between parties upfront. This makes for a much more efficient use of time and resources – and faster turn around of the contract. More complex agreements will likely result in increased negotiation between the parties. Take some time to draft up a list of priorities with the things that you need to have to make the deal worthwhile and areas that you’d be willing to compromise on to get the deal across the line. Then gameplay it. What do you know your business partner needs to make the deal worthwhile? How can you come to an agreement with mutual benefits for both parties?

You might also want to give some consideration as to what becomes a ‘deal breaker’ situation and at what point you consider walking away from the negotiation. It’s such a momentous achievement when you’ve closed the big deal and popped the champagne. However, you should make sure you start off your partnership on the front foot, with the right structures and contract in place.