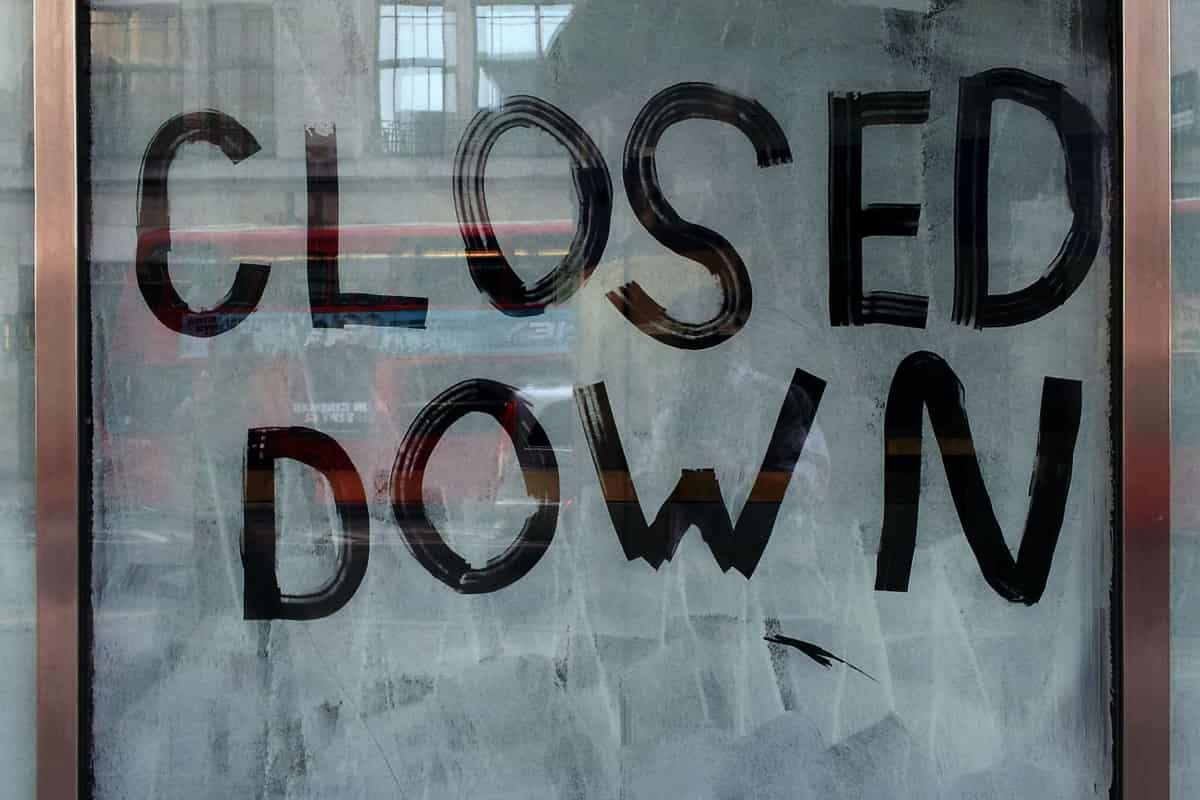

The outbreak of COVID-19 has led to many businesses going bust, with many forced to go into administration. This has left devastating impacts on the economy, some of which pass onto consumers.

It can be disappointing to find out that a product you ordered from a particular company may be under risk when the company goes bust. This can also affect your reservation deposits or gift card purchases. This article will explain what happens when companies go bust and what you can do to address the situation.

What Happens When Companies Go Bust?

When companies are unable to pay their debts they become insolvent and declare bankruptcy. Sometimes this results in voluntary administration, where a company consensually appoints administrators to advise the company. In other instances, courts appoint external administrators to investigate the company. This investigation leads to recommendations usually to restructure the company, sell it or wind it up (shut down). We will be discussing what you can do during administration.

Can you still receive your product?

An administrator usually tries to maximise the sale value of the company. This often means they’ll still keep the company running. This has a few consequences. Firstly you will likely receive goods you ordered if supply lines are intact. Furthermore, it is usually safe to continue purchasing from a company in administration as it’s still in their interests to make money from selling.

In addition, administrators usually honour gift cards and lay-bys through alternative arrangements. For example in 2016 Dick Smith went into administration and made an agreement with Coles and Woolworths. Under this agreement, customers could exchange Dick Smith gift cards with Coles/Woolworths gift cards of equivalent value. These arrangements should also apply to guarantees and warranties. If you have concerns regarding these you should contact ASIC.

Can you get a refund?

In some instances, the company ceases to function normally and you may want a refund. Importantly, when a company goes into administration, the priority is to pay off its debts. Thus, it’ll pay off its largest debts first, usually to secured creditors, employers and shareholders. Customers typically come last in the process. In this instance, how you pay matters.

1. By Credit card

The advantage of this payment method is that you are usually better protected when a company goes bust. This is because you are loaning from a larger institution which has more leverage over demanding money back. It is also possible for you to get a chargeback. This is particularly important for travel plans, where bust tourist, flight and accommodation companies are increasingly trying to hold onto their money. Banks can be liable under s75 of the Consumer Credit Act. Notably, some of these claims have a time limit so be sure to contact your financial institution as soon as possible.

2. By Cash, cheque or savings

If you purchased through cash, cheque or savings, then you are last in the queue to be paid back. This often means you’ll have to wait for the outcome of the administration. You may not get your money back if the company winds up or is sold. Fortunately, in many instances companies are often restructured – in these instances, companies can possibly pay you back.

How to contact the administrator

You will often find out about companies going under administration in the news. ASIC provides the details of administrators that you can contact.

Summary

Making claims on your goods or demanding refunds from companies under administration can be a frustrating process. A number of variables can determine the outcome – how the company chooses to proceed in administration or how you paid. Be sure to contact our experienced consumer lawyers if you need help in making a claim or are confused by the process.