No one likes talking about tax. No one. Yet the envisaged tax changes suggested by Joe Hockey affect personal tax and therefore, directly affects you. If you are an Australian resident and earn an income, you fall within a tax bracket.

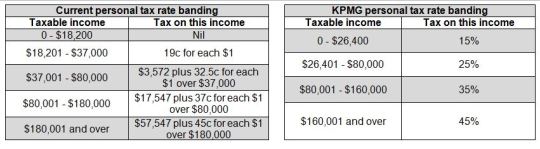

Just yesterday, consultancy giant and tax expert KPMG issued a model personal income tax plan in anticipation of the Tax Reform Summit later this month. Some of its features include the removal of a tax-free threshold and four new brackets linked to average earnings.

The proposition was suggested as a solution to the ‘bracket creep’.

What is the bracket creep?

Australia’s tax system is a progressive taxation system so the government levies taxes depending on your earnings defined by tax brackets. However, tax brackets are not adjusted for inflation. That means that although the value of $1 changes over time, the limits of each tax category do not change. Bracket creep is when people are forced into a higher bracket because of inflation.

For example, in 2014, if you earned $36,500 and your wage is adjusted for inflation so that in 2014 it increased to $37,408.09, then you will no longer be within the second tax bracket but the third. Adjusted for tax, you will be earning $22,839 which is $6,726 less than in 2013 ($29,565).

It also increases the overall average tax rate.

The KPMG tax plan

The implication of the bracket creep is a disincentive to productivity. If you work more and earn more you may lose out. In response, KPMG’s plan focuses on increasing labour participation among the lower incomes and women. In both cases, to work more may affect welfare payments.

To address female under-participation, KPMG proposes reforms for childcare benefits including assessing it with regards to the child rather than joint income and exempt employer-funded top-up childcare from tax.

Reassessing tax brackets should not be shied away from. KPMG’s plan is a novel one, being the first to put forward 4 new tax brackets. Certainly one thing we can take away from KPMG’s plan is the importance of regularly reviewing brackets. However, whilst there is a lot that we can learn, the plan has also received wide critics.

What the critics are saying

Although KPMG’s may raise some valid considerations, the premise for the proposition is contentious. It focuses primarily on changing personal tax rather than the whole of the tax landscape. In particular, Brian Toohey argues that indexing the brackets may only change the bottom bracket by $1 a week and the $37,000 bracket by $1.50. The gains are too low to have the desired effect of promoting entrepreneurship or additional training.

Joe Hockey’s grandiose cause to rid Australia for the tax bracket may also be overstated. Ben Phillips, a researcher at the University of Canbera’s National Centre for Social and Economic Modelling (NATSEM), argues that although there has been bracket creep, ‘if you go back historically, we’re actually better off, that is, individuals are paying a lower average rate of tax.’

The real issue may be that there is no ideal tax rate. It is advisable to reassess the tax brackets in terms of its effectiveness, equity and productivity; they are, after all, a significant tool to address broader social issues. One simple solution being proposed to address bracket creep is to integrate inflation into the tax plan.

How will your disposable income be affected by tax reform? Let us know what you think about the government’s solution to bracket creep by tagging us #lawpath or @lawpath.