Parissa is a recent Bachelor of Laws/Bachelor of Arts graduate from the Australian National University. She is completing her Practical Legal Training at Lawpath. Her interests are legal technology, employment law and the accessibility of legal services.

💡 Key insights

States and councils across Australia enforce unique licensing, hygiene, and insurance requirements for salons and spas. Research local rules before you launch.

Public liability, professional indemnity, and workers’ compensation insurances are critical protections; a lack of coverage can expose owners to costly claims.

Council permits, infection control systems, and up-to-date legal documents (contracts, agreements) reduce legal risk and support business compliance.

Lawpath offers legal templates, contract guides, and links to insurance partners, making it easy for salons and spas to set up and comply with regulations.

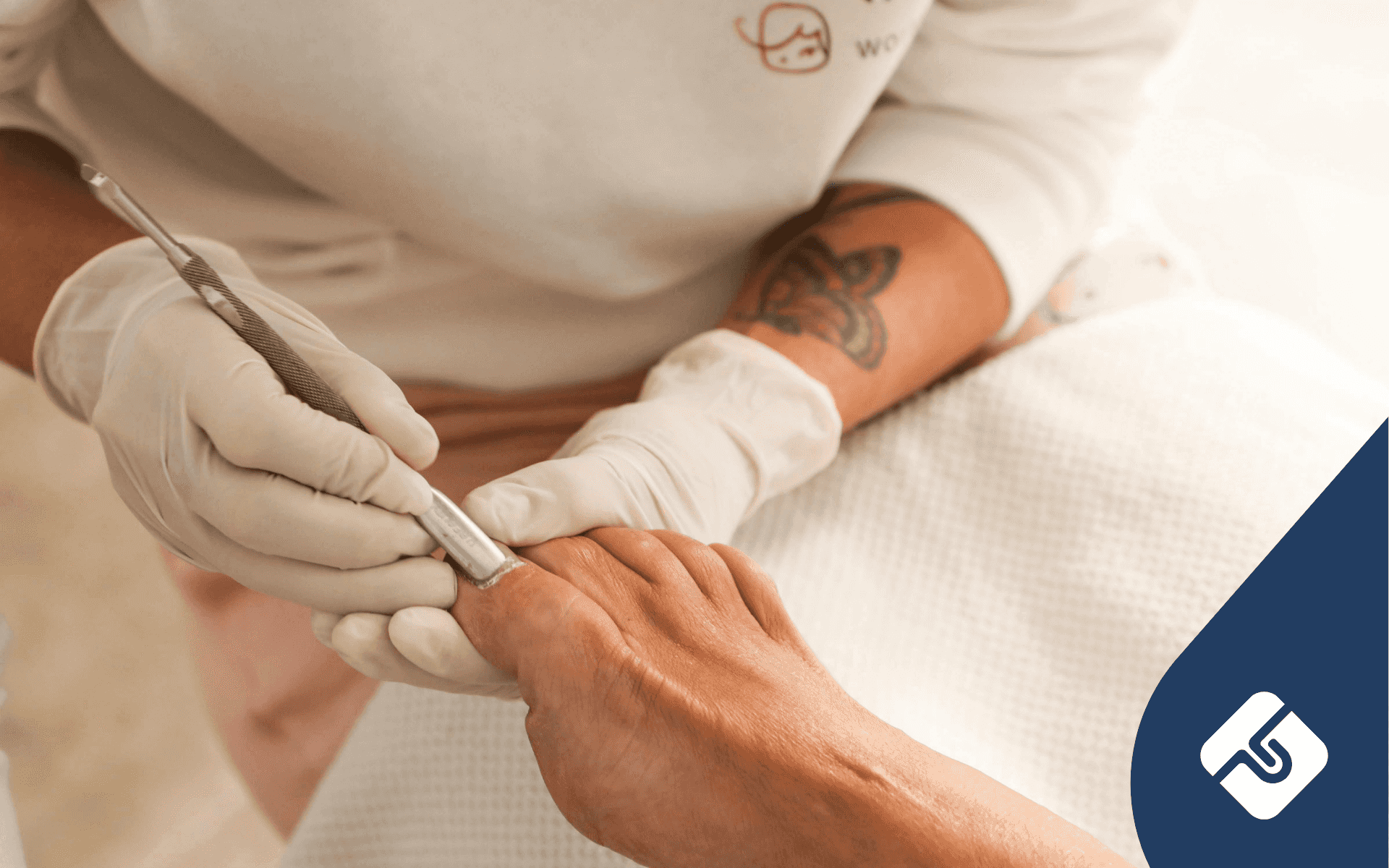

Launching a salon or spa comes with a range of legal responsibilities that help protect your clients, staff, and business. From council permits to infection control standards, you’ll need to take care of all salon and spa legal requirements in Australia to remain compliant.

Failing to comply can result in shutdowns, fines, or expensive claims. Plus, requirements can differ by state, council, and service type.

Whether you run a hairdressing studio, nail bar, beauty clinic, or a home-based massage room, understanding these obligations is key to a successful and legitimate operation.

In this guide, we’ll walk you through the details, so you can rest assured that your business complies with Australia’s legal requirements.

Table of Contents

Legal requirements for salons and spas in Australia

Every salon and spa faces several core compliance duties. These may seem daunting if you don’t have a clear picture of your obligations. Below is a high-level overview:

- Licences and permits: Hairdressing, beauty, massage, and skin penetration services require business registration and industry-specific permits. State-based systems mean requirements vary widely.

- Council approval: You must get planning approval for business premises, whether commercial or home-based. Local rules may restrict invasive procedures, noise, traffic, and signage.

- Infection control: Australia strictly regulates hygiene standards. Tools, products, premises, and procedures must meet state-specific health regulations. Your staff also require training.

- Workplace Health & Safety (WHS): Business owners have a legal obligation to provide a safe workplace, with controls for hazardous substances, fire protection, electrical systems, incident reporting, and staff induction.

- Insurance: Salon operators should have several types of insurance. These include public liability, professional indemnity, workers’ compensation (if employing), product liability, and property cover for equipment.

- Staff compliance: Proper employment contracts are mandatory, along with work policies and legal documents that protect your staff.

Remember that each state and territory has different rules, so you’ll need to check local government and council resources before opening. If operating in multiple locations, each will need to comply with the specific local regulations.

Legal Health Check for Small Business

Uncover your small business’ legal gaps in minutes with this award-winning tool.

Business licences and permits you’ll need

Australian salon and spa owners are subject to federal, state, and local licensing regulations. Some registrations apply to all business owners, while others are specific to your industry or state. Let’s take a closer look.

Universal requirements

- ABN registration: All businesses need to register for an ABN. If you choose a company business structure instead of operating as a sole trader, you’ll also need an Australian Company Number (ACN).

- Business name registration: If you operate under a name other than your own, register through ASIC.

- Council planning approval: Local councils control zoning, signage, parking, and permitted services. You’ll need to get approvals for all of these, whether you run your business from home or externally.

- Health/Beauty service permits: Most beauty, hair, and health services (especially those involving skin penetration or massage) require specific permits or notifications.

State variations

There are substantial differences across licensing and permit from different states and territories. For example:

- Hairdressing licence: Required in QLD (via local council) but not in NSW or VIC for standard services.

- Skin penetration licence: Needed for tattooing, piercing, or certain beauty treatments, regulated at the state and council level.

- Massage permit: Massage businesses may require council approval and registration, especially if they advertise therapeutic services.

- Cosmetic tattooing permits: Strict state regulations apply; training and hygiene audits are common.

Lawpath can guide you through the legal business set-up process and the local specifics for your salon or spa. Get in touch with us today!

Need Financial or Legal Advice for your small business?

Common salon & spa permits

Below is an at-a-glance summary of the permits you need.

| Permit | Applies to | Issued by | Notes |

| ABN/ACN Registration | All businesses | ATO/ASIC | National requirement |

| Hairdressing Licence | Hairdressing salons (varies) | Local council/state | Only QLD and some councils |

| Skin Penetration Licence | Tattooing, piercing, and microblading | State/council | Required everywhere |

| Massage Therapy Permit | Massage/spa businesses | Local council/state | Not always needed, check locally |

| Cosmetic Tattooing Approval | Cosmetic tattoo businesses | State/council | Requires extra audit/training |

| Zoning Approval | Home-based/retail salons | Local council | Parking/noise limits |

Hygiene and infection control laws (state-by-state)

Every state and territory enforces regulations to ensure salons and spas are sanitary, safe, and compliant with health laws.

- Sterilisation: You must properly clean and disinfect all reusable instruments between uses.

- Single-use tools: You must not reuse critical tools for skin penetration, waxing, or manicures.

- Sharps disposal: Safe containers for needles, blades, and lancets are compulsory.

- Waste management: Hair, bodily fluids, wipes, and chemical waste need secure disposal.

- AHPRA regulation: The Australian Health Practitioner Regulation Agency does not regulate typical beauty salons unless you perform medical or cosmetic procedures. Cosmetic injectors and some tattoo practices may require registration.

NSW requirements

- Salons must register with their council and comply with local business and planning rules.

- Your business must comply with the Public Health Act, which regulates skin penetration businesses through compulsory training, premises audits, signage, and infection control protocols.

- Tattooing, waxing, microblading, and needling must follow state health protocols.

VIC requirements

- Most salons must notify councils of skin penetration.

- You must also follow the Public Health and Wellbeing Act guidelines for hygiene and infection control.

QLD requirements

- Hairdressing and beauty businesses need council approval and compliance with the Public Health Regulation 2018.

- Extra rules apply to skin penetration procedures.

WA requirements

- Beauty therapy premises must comply with the Health (Skin Penetration Procedure) Regulations and local council planning.

SA requirements

- Skin penetration businesses are regulated through the Public Health Act; notification and adherence to standards are required.

TAS requirements

- Beauty premises must notify councils of certain services and comply with infection control standards.

ACT requirements

- Skin penetration, tattooing, and piercing require council approval and adherence to infection control protocols.

NT requirements

- The Environmental Health Unit oversees approval and audits for skin penetration businesses.

Workplace Health and Safety (WHS) obligations

As a salon or spa owner, you will need to ensure your premises and operations are safe as per Work Health & Safety laws.

- Electrical safety: Test and tag equipment annually.

- Chemical handling: Securely store and label chemicals. Provide staff with appropriate protective equipment. Also, maintain safety data sheets for products.

- Ventilation: Ensure appropriate airflow to reduce chemical exposure and odours.

- Hazard reporting: Register any incidents and follow reporting protocols to manage accidents or exposures.

- Staff training: You must include a mandatory induction (covering manual handling and infection control) and regular updates on procedures.

- WHS policy: You’ll need a Workplace Health and Safety Policy to manage these details and protect your employees and your business.

In addition to the above, employing staff triggers strict obligations under the Fair Work Act and national WHS codes.

Get a fixed-fee quote from Australia's largest lawyer marketplace.

Insurance requirements for salons and spas

Your salon faces real risks, including chemical burns, allergic reactions, slip hazards, equipment damage, and the spread of infections. Proper insurance helps you avoid extreme legal costs and keeps operations running smoothly.

You’ll need:

- Public liability insurance protects against claims from clients or visitors who are injured on the premises.

- Professional indemnity insurance that safeguards against loss due to negligent service or advice.

- Workers’ compensation insurance is compulsory if you employ staff. It protects employees in the event of a work-related injury.

- Product liability insurance covers harm from products supplied or used.

- Property and contents insurance protects valuable salon equipment, stock, and furniture.

Lawpath offers access to insurance partners who can tailor coverage for salon businesses, making the process more affordable and transparent.

Contracts and legal documents for spa and salon businesses

In addition to compliance with beauty salon legal requirements in Australia, you’ll also need to protect your business, staff, and clients through robust legal documentation. Here are some must-have documents.

- Client service agreements set expectations for bookings, treatments, and client responsibilities.

- Staff employment contracts outline duties, pay, leave, and disciplinary rules.

- Independent contractor agreements clarify legal status for chair renters, freelance therapists, or practitioners.

- Chair-rental agreements establish rights/responsibilities when renting out part of the salon space.

- A privacy policy governs how you handle client data and booking records. This document is mandatory under Australian privacy laws.

- A refund and cancellation policy details terms for client cancellations, refunds, and no-shows.

You may need additional documents depending on your business scope. Make sure that all your contracts and policies are legally enforceable and effective before you begin providing services.

Renting a chair or room — Your legal obligations

Renting out a chair or room in your salon is a common way to boost income, but it comes with legal risks.

Normally, you’ll rent a chair or space to a contractor who has their own business. This means they set their own schedule, invoice you, supply their own products, and have an ABN.

However, if you set strict terms, control working hours, or limit where the renter can work, the Australian law may actually consider the person your employee. This could happen even if you have a contractor agreement in place.

Misclassifying a worker can result in hefty fines, back pay for superannuation and leave, and tax liabilities. The tax and insurance implications are also significant. Employees are linked to your payroll, receive entitlements and super, and are covered by your insurance.

Getting this wrong can trigger audits and back payments, so use industry-specific contracts and check Fair Work guidelines before renting out space or engaging new workers.

Get on demand legal advice for one low monthly fee.

Sign up to our Legal Advice Plan and access professional legal advice whenever you need it.

Home-based beauty salons — Main differences

Many entrepreneurs launch beauty or massage businesses from home, but the compliance rules remain strict. You’ll need to comply with several unique obligations.

- Zoning rules: Councils restrict commercial activities in residential zones. Parking limits and signage rules may apply.

- Parking/Traffic: If too many customers park near your home, the local council may take action.

- Council permits: You’ll need approval for home occupation and certain beauty services.

- Hygiene rules: The same infection control standards apply as in commercial premises.

- Insurance updates: Review property insurance since business use can void home-only policies.

- Extra approvals: Renting rooms or offering invasive services may lead to additional requirements or health audits.

Complying upfront prevents disruption and fines, allowing home salons to operate successfully and safely.

Costs to meet legal requirements

So, how much does meeting all beauty business requirements cost? Let’s take a look at the typical ranges.

- Permits/Licences: $150–$800 per service or council.

- Business registration: An ABN is free, while ACN registration is approximately $400. You can also access affordable business registration packages through partners like Lawpath.

- Insurance premiums: $500–$1,500 per year, depending on cover.

- Contracts/Templates: Free to $300+ via legal template providers.

Typical compliance costs

| Item | Typical Range | Notes |

| Permits/Licences | $150–$800 | Per service/council |

| ABN/ACN | Free–$400+ | ABN is free, ACN for companies |

| Insurance | $500–$1,500/yr | Depends on the cover chosen |

| Legal Templates | Free–$300+ | Lawpath/other providers |

Costs depend on your business type, location, and the services you provide. Also, advanced procedures (skin penetration, tattooing) attract higher compliance expenses.

Common compliance mistakes (and how to avoid them)

Many salon and spa owners stumble over the same legal hurdles:

- No insurance: Failing to obtain proper insurance exposes your business to costly claims.

- Incorrect permits: If you don’t have the correct council or skin penetration approvals, your operations are at risk.

- Poor record-keeping: Not keeping proper incident logs, contracts, or hygiene records can lead to audits an fines.

- Inconsistent sterilisation: Breaching infection control rules is a serious offense that can lead to strict penalties.

- Missing contracts: Without service or staff agreements in place, you’ll risk misunderstandings and legal action.

To protect your business and mitigate these risks:

- Use online legal platforms like Lawpath for easy access to templates, registration, and advice.

- Regularly check legal updates with your local council and nationwide regulations.

- Set up reminders for permit renewals and insurance coverage.

- Maintain digital records of training, sterilisation, incidents, and contracts.

FAQs

What legal documents do I need for a beauty salon?

Client service agreements, employment contracts, independent contractor agreements, privacy policies, and refund/cancellation policies are essential.

Do I need a licence to open a beauty salon in Australia?

Yes. Most salons require council registration and specific licences or permits, particularly for skin penetration, massage, or tattooing. State and council rules differ.

What are the hygiene requirements for salons and spas?

Sterilisation, single-use tools, safe waste disposal, and regular audits are required. Check with your local health authority for state-based standards.

What insurance does a salon or spa need?

Public liability, professional indemnity, workers’ compensation (if you employ staff), product liability, and property insurance are recommended.

What permits do I need for a home-based salon?

Home salons require council zoning permits, may need approval for skin penetration or massage, and must adhere to hygiene rules, just like commercial studios.

Does AHPRA regulate beauty salons or cosmetic services?

AHPRA does not typically regulate beauty treatments. However, it may apply to medical or invasive cosmetic procedures performed by healthcare practitioners.

What happens if I operate without the correct permits?

Council fines, forced closure, and liability for harm or infection are common. Get permits and insurance before launching.

Start your salon or spa the right way with Lawpath

Building a compliant and successful salon starts with the right foundations: business licensing, contracts, infection control protocols, and insurance coverage.

Lawpath empowers salon owners to get ABNs and ACNs, download customisable legal contracts, review compliance checklists, and connect with insurance partners. With Lawpath’s resources, you can launch with confidence, meet all obligations, and focus on delighting clients.

Want more?

Sign up for our newsletter and be the first to find hand-picked articles on topics that we believe are crucial to successfully scale your unique small business.