Are you considering starting an online small business? If so, you may need an Australian Business Number (ABN). Having an ABN allows you to run your online services as a business.

Furthermore, you’ll need one to register for the majority of Australian website domains.

If you want to know whether you need an ABN to sell your goods online, the benefits of having an ABN, and the answer to other frequently asked questions.

Read along!

What is an ABN?

An ABN is a unique 11-digit number that allows you to run a business in Australia.

You’ll need to provide relevant identification details in order to acquire one.

You’ll also require an ABN if you want to register a business name. You’ll need to apply for a new ABN even if you have an existing one for another business.

Benefits of registering an ABN

Whether you run your online operations as a business or a hobby having an ABN will provide you with the following advantages:

- It will enhance the legitimacy of your business to customers by including one on your tax invoices or website

- It allows you to claim back GST credits and will assist you in making operations with other businesses an easier experience.

- Through having an ABN, you can offer your employees fringe benefits tax(fbt)

- Your business will be more identifiable as having an ABN will mean your business is listed on the Australian Business Register (ABR)

- Having an ABN will allow you to register a domain name. In Australia, most domain names in Australia have the extension .com.au, .au or .net.au. To register a domain name with one of these extensions, you’ll need an ABN. Although you can apply for your .id.au domain name using your Australian Company Number (ACN) or trademark number) you won’t be able to use the website for commercial purposes.

When do you need an ABN to Sell Online?

To determine whether you’ll need an ABN, you must decide whether you sell goods/services online as a hobby or a business.

However, as a business owner, you’re not required to have an ABN if your business turnover is less than $75,000 a year, but it’s highly recommended.

It is also important to consider goods and services tax (GST). You are required to register for GST if your online sales/ business has a turnover of more than $75,000 per year (prior to GST). If your turnover is sufficient to register for GST, you’ll also need to register an ABN. If you need to hire employees as part of your business, you’ll need an ABN to register for PAYG Withholding.

Selling as a Business

In simple terms, if you’re operating a business and your primary goal when selling goods/services is to make a profit, then you must have an ABN. You’ll need to display your ABN on invoices and receipts you issue to your customers. Businesses will typically sell products for the purpose of making a profit and generating repeat sales over an extended period of time.

Here’s an example:

Jay Shawn is an entrepreneur who has created an online store using the e-commerce platform Shopify where he sells rare sneakers. His running costs for his business are $4,000 annually.

The total value of the sneaker sales is $78,000. Jay finds selling the sneakers enjoyable and begins to look around to locate other rare items to sell and begins to drop ship some new shoes as well. He finds rare caps, repairs them, and begins to make a profit by selling them as well.

Jay doesn’t pay for advertising. However, he uses social media apps such as Instagram and online marketplaces to promote the items he sells.

Although Jay began selling these rare items as a hobby, it can be stated that he is operating a business for the following reasons:

- He has created a dedicated online store to sell his goods

- He advertises his goods using social media and online marketplaces

- He profits from the items he sells

- He sells his goods repeatedly over an extended time period

- He refurbished items and then sold them to make a profit

Selling as a Hobby

You would fall into the category of selling goods as a hobby if the following apply to you:

- You don’t pay for or use an online shop/website to sell your goods

- You make one-off sales. For example, you sell second-hand items like a bike or an individual piece of clothing

- Your primary goal in selling goods is not to make a profit

- You don’t intend to transform your online store into a long-term commercially viable business

Here’s an example:

Sally wants to get rid of the clothes in her closet that she no longer wears. Each piece of clothing is individually listed by her on eBay. She sells some items at a price higher than her purchase price, while she sells others at a lower price.

Through selling these items, she generates $1,800.

Sally would be considered to be selling as a hobby due the following reasons:

- She didn’t do anything to increase the value of the clothes

- She didn’t continue selling her clothes

- She didn’t create or pay for an online shop to sell her clothes

- She would typically sell the clothes at a lower price than the price she bought them for

- She had no intention of running a business selling clothes online

Questions to ask yourself if you’re unsure whether you’re selling as a Business or a Hobby

If you answer “yes” to the following questions, created by the Australian Taxation Office (ATO), then you’re most likely closer to selling as a business than a hobby:

Was your online store created with the intention of becoming a business?

If you created a ‘shop’ to sell, it’s likely that you intended to operate a business.

Do you pay to sell your goods or services online?

If you’ve paid money to sell your goods or services, it’s likely that you intended to operate a business.

Other factors that could be considered include the following:

- You have a brand name

- You have an official online business name

- Other features consumers typically expect from businesses

Is making a profit your primary purpose?

If your primary purpose of selling online is to make a profit, you’re more likely selling as a business rather than a hobby.

Do you make repeat or regular sales?

You probably run a business if you sell items online regularly.

A number of different customers or an individual customer can be the recipients of the sales.

Does your profit exceed your production costs for the goods you sell?

If your profit exceeds your production costs, it’s likely that you’re operating a business.

For example, if you produce a good at a low cost but charge a much higher price for it when selling it online. Regularly doing this suggests that you’re running a business.

Is your online selling activity managed like a business?

If you run a business using your online space, it’s highly likely you’re doing the following:

- You’ve created processes and systems to manage your online-selling activity

- You’ve created advertisements for your online-selling activity

- You created a business plan

- You keep records of your online-selling activity regularly or occasionally

- If you sell products similarly to businesses with similar products

- You have business information

Are the products you’re selling online the same or similar to those that are sold in a physical store?

It‘s likely that you’re operating a business if your goods or services can be easily found in a physical store.

If you’re still unsure whether you’re selling as a hobby or business, you can hire a lawyer to help you decide.

What you need to know about using an ABN to sell on Etsy, Facebook or eBay

Here’s what you need to know regarding whether an ABN is required when selling on Etsy, Facebook or eBay:

- ABN to sell on Etsy

Whether you need an ABN to sell on Etsy depends on how much profit you’ll receive and the purpose of selling on Etsy. With Etsy having an estimated 96.3 million purchasers in 2021, you’ll reach a large customer base.

- ABN to sell on Facebook?

Similarly to Etsy, whether you’ll require an ABN to sell on Facebook depends on how much profit you’ll make and the purpose of selling your goods on Facebook. For example, if your online-selling activity has a turnover of $75,000, you’ll need an ABN.

With over 800 million individuals using Facebook marketplace as of 2018 to sell, buy or look for goods, it’s a great tool to utilise.

- ABN to sell on eBay?

Similarly to other platforms, whether you’ll need an ABN to sell on eBay is based on whether your online selling activity is a hobby or business and the amount of money your operations generate. If your annual turnover is greater than $75,000, you’ll need an ABN to sell on eBay.

What do you need to provide for an ABN application?

Depending on your business structure information you may be required to provide when registering for an ABN includes the following:

- Your tax file number (TFN)

- If your business has associates, you’ll also be required to provide their TFNs, associates include trustees, directors and partners

- ABNs you’ve held in the past

- Australian Company Number (ACN). You can register for an ACN through the Australian Securities and Investments Commission (ASIC)

- The date you require the ABN for your business activities. However, the date must be within six months of the application date

- The contact details of your business, including its phone number, email address, address and postal address

- Your business activity, for example, manufacturing, construction, agriculture etc.

- The locations of your business

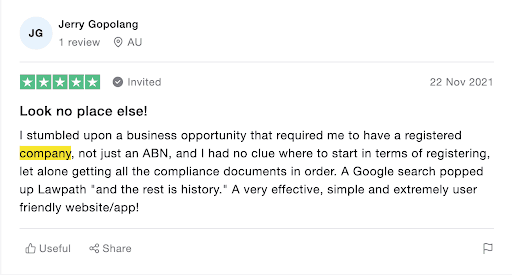

How can Lawpath help?

Registering your ABN with Lawpath has many benefits and helps you save time. Our ABN services have the following benefits:

- Easy and fast online registration

You can complete your online application for an ABN in less than five minutes. Our interactive form provides you with all the information you need to complete your application, and our team is always available to assist you.

- Verified ABN provider

Lawpath is a verified ABN provider. Therefore, your application will be processed securely and properly. We provide ABN registration for every stage of your business journey, allowing you to register your business whether you are a sole proprietor, a trust, a company or a partnership.

- Exceptional customer support

Our customer support team is available to help you navigate the ins and outs through phone and email so that you can focus on doing things you love—taking care of your business!

Conclusion

Although you may not be legally required, we advise registering an ABN if you’re selling online. We’ve got you covered, so why not try our ABN registration services and see how we can help. We suggest hiring a lawyer if you require further assistance with registering your ABN.