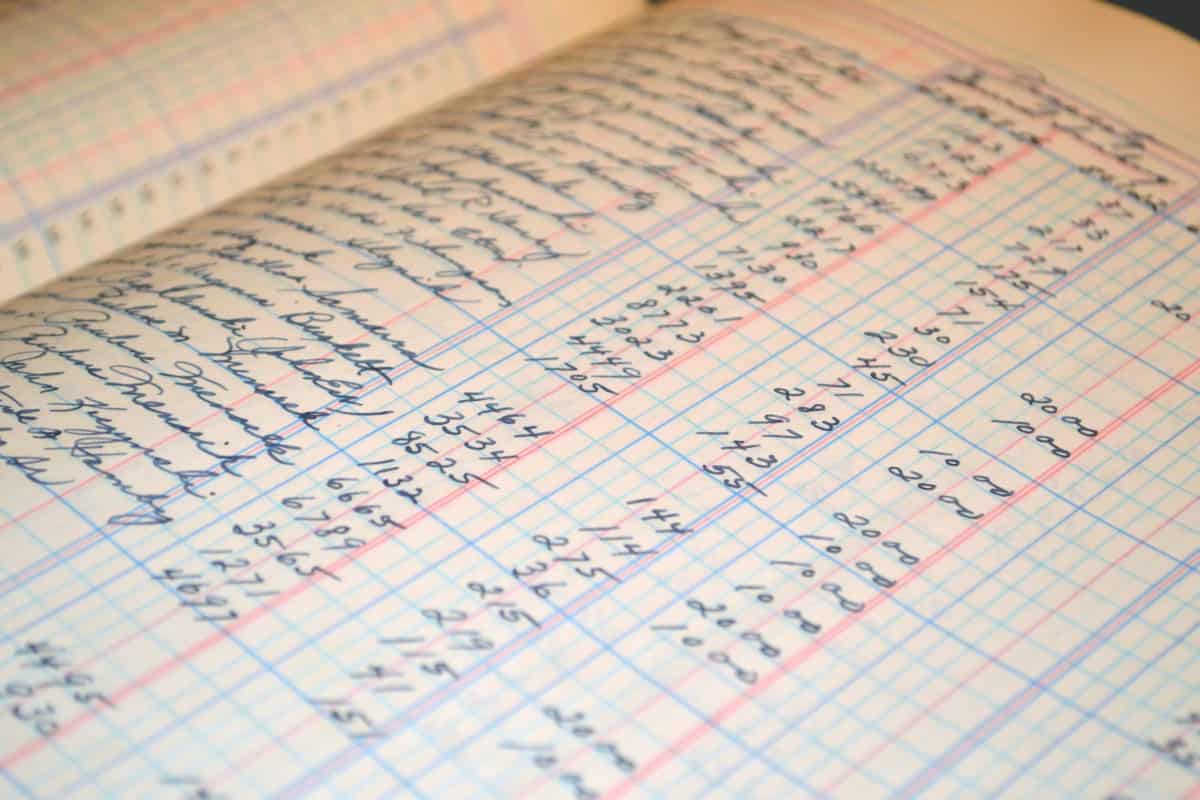

A general ledger is an essential accounting tool for any business. It is the principal form or record in which information about all transactions is kept. General ledgers assist businesses in sorting and summarising information about where your money is spent and the sources from which it is received. It was once kept handwritten in books. In fact, some people still prefer to handwrite smaller transactions. This is a ‘general journal’. However, in the modern era, businesses often use software to retain all of their business information.

General ledgers sort transactions into different accounts. These accounts allow a third party to look at these documents and easily understand a few things. These breaks down exactly how much money a business makes, how much it owes, how much it has in assets, how much it spends and what the business is worth overall. They are essential to running your business. There are a few things that a general ledger usually includes.

What does a General Ledger Include?

The general ledger will usually cover an overview of different, more specific accounts. These are sub-ledgers. Sub-ledgers are separate documents that better detail what each asset or liability means for the business and what financial impact it will have. Maintaining each of these accounts is the best way to keep ahead of the taxman come tax time. Below are three examples of transactions you will want to keep in a general ledger.

Assets

Asset accounts are fairly self-explanatory in accounting. These refer to what you own. They’re written in sub-ledgers in terms of how much each asset is worth. This can include simple things like cash, and sometimes more complicated items such as your inventory and ‘accounts receivable’. Accounts receivable is money you’re owed from other businesses. For example, you do contract work for another business. They agree to pay you at a later date. The money owed to you is considered ‘accounts receivable’.

Liabilities

Liabilities are a little more tricky in accounting. These refer to what you or your business owes. They cover a broad range of categories from the little things, like interest payments on debts, to the entirety of debts themselves. ‘Accounts payable’ is also included under the liabilities sub-ledger. This refers to what your business owes another for work done in advance of payment. For example, a contract worker does something for your business. You agree to pay them at a later date. This money owed is considered ‘accounts payable’.

Equity

This is also known as the statement of owner’s equity. These entries into the general ledger refer to what the business itself is worth. There’s a broad range of items included under the equity umbrella. The most important for small businesses would consider is the contributions and deductions of the business owner. For example, if your business is performing well, you may decide to use some of the profits for personal reasons. This would be a deduction. On the other hand, if your business is struggling, you may want to contribute some of your personal savings. These are owner contributions.

The General Ledger is Key!

General ledgers provide a good overview of how your business is functioning financially. They’re important to keep not only for your own benefit but for when tax time comes around too! It is essential to have one if you’re running a business. If you’re starting a business and need any financial advice, don’t hesitate to seek out one of our trusted financial service lawyers.