Indemnity clauses are used in contracts between two parties to shift risk from one party to another. Understanding indemnities as an employer, employee, supplier or service provider is important, as indemnity clauses in a contract define what you may be liable for in specific circumstances. Knowing how to properly draft an indemnity clause in a contract can be the defining factor in whether or not you may be held financially liable for specific acts. We have provided a comprehensive guide with examples to assist you in understanding what indemnity clauses are and how they impact you.

Table of Contents

What Are Indemnity Clauses?

An indemnity clause in a contract is a promise made by one party (the indemnifier), to another (the indemnified), who agrees to compensate for any losses when a specific act or risk occurs. The Public Governance, Performance and Accountability Act 2013 provides how indemnities are a “legally binding promise”. clauses mitigate the risks that may arise and promote fairness to parties by ensuring the indemnified is not held accountable for actions that would fall under the indemnifier’s scope of liability.

When Are Indemnity Clauses Used?

Indemnity clauses are found in contacts between two parties and are circumstantial. Indemnity clauses are usually found in contracts when one party wants to protect themselves from liability of specific acts occurring, or when one party wants to provide assurance to another. Indemnities are used to spread risk and ensure compensation is made by the indemnifier to the indemnified and comes across financial loss in response to a specific event or risk occurring. Indemnity clauses are used when defining the scope of liability each party has when the indemnified faces specific acts or risks.

Importance of Understanding Indemnity Clauses

It is important to understand indemnity clauses as they define who bears the financial burden of specific acts occurring. Understanding the potential financial consequences that may arise in the future enables parties to prepare themselves accordingly. When entering a contract that has an indemnity clause, it is important to be aware of any liability you or another party may have when specific events occur.

Indemnity Clauses in Different Agreements

Indemnities look different depending on the type of agreement between the parties. Below are some examples of what indemnities can look like in different agreements.

Non Disclosure Agreements

Non disclosure agreements are used to prevent confidential information from being shared and the consequences that will arise if such information is shared. Indemnity clauses in an NDA often address the consequences of breaching confidentiality in a contract and establish that compensation is required if such a breach occurs. NDAs often contain indemnity clauses to specify a breach of confidentiality and clarify the accountability of one party if they fail to hold specific information private.

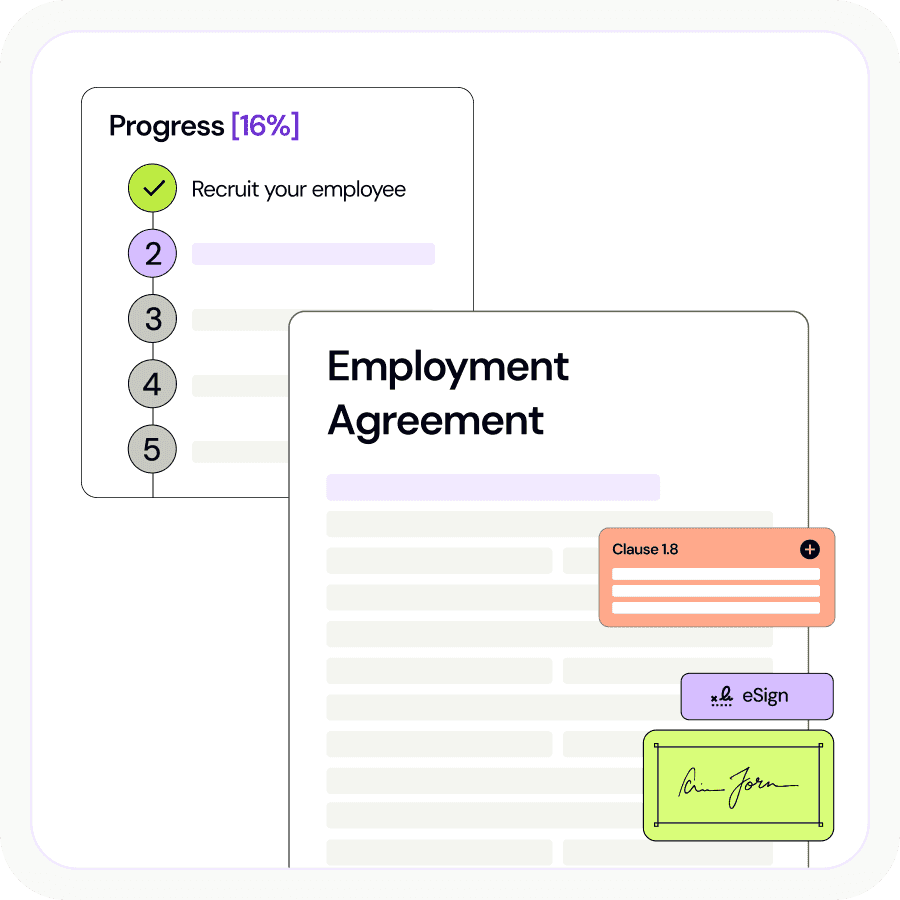

Employment Agreements

Indemnity clauses in employment agreements can be used to serve different purposes. When an indemnity clause is used in an employment agreement, it can prevent the employer from being held accountable for the negligence or recklessness of their employee. Employees may seek an indemnity clause in their employment contract as a proactive method to avoid incurring financial responsibility. For example, an employee may seek indemnification for any legal costs that may arise in response to them performing specific acts encompassed under their role or specified in their employment contract.

Service Contracts

Indemnification may be sought in service contracts to ensure one party is not held liable for another party’s mistakes made during the service. Indemnity clauses in a service contract could outline any financial responsibility the provider of the service may have on the service receiver if they perform negligently. An indemnification clause in a service contract would also provide clarity to the service provider by defining the scope of what the receiver is limited and entitled to seek financial compensation for.

Sale Contracts

Indemnity clauses in sales contracts are used to protect both the seller and buyer. They may also define the accountability of the seller if a third party (such as a customer) seeks legal compensation in regards to an item sold by the buyer to the general public. An example of an indemnity in a sales contract may define the financial and legal consequences of the seller if their products are defective or faulty.

Benefits of Indemnity Clauses

Allocation of Risks

Indemnity clauses fairly allocate risks between the parties in a contract. As indemnity clauses are customisable, the allocation of risks are considerate and equal. Indemnity clauses provide an extent of financial protection by allocating such risks. An example of this is when one party may agree to indemnify the other against specific types of losses or claims.

Clarity and Reassurance

Indemnity clauses are specific, meaning there is clarity and reassurance for both parties in the contract when an indemnity clause is used. Both parties are aware of who would be held accountable for specific actions.

Flexibility and Customization

Whilst indemnity clauses are specific, they are flexible and customisable. Indemnity clauses can be negotiated and are discussed before being put in a contract. In response to this, indemnity clauses are highly adaptable and tailored to the business’s situations.

Challenges in Drafting Indemnities & Tips for Drafting an Effective Indemnity Clause

Specificity

An indemnity clause that is ambiguous is challenging to enforce. As indemnities are legally binding, without specificity will be difficult to interpret by the Courts if necessary. To avoid generalities, ensure you outline the scope, limitations and specific circumstances a party would be held liable. When drafting an indemnity clause, it is highly recommended you seek advice from a lawyer to assess the specificity.

Negotiation

When forming an indemnity clause in a contract, it is important to ensure that the interests of all parties are met. When drafting an indemnity clause in a contract, it is important to avoid sacrificing the needs and requirements of each party to avoid future legal disputes. We recommend having open conversations with all parties involved when indemnities are formed within a contract to prevent indemnities.

Contingency

In response to unforeseen events, changing laws and regulations, market conditions and technological developments, it is important for parties to ensure the indemnity clause is susceptible to change. Indemnity clauses may be constantly reviewed in response to external changes, some contracts include provisions that consider “all future events” as well.

FAQs

What is The Difference Between an Indemnity Clauses and Liability Clauses?

A guarantee is a promise where one party (the guarantor) agrees to accept the failure of another party’s failures (the obligator) which are owed to the another party (the beneficiary). Whilst indemnities and guarantees are promises in a contract, they differ in a few ways. Guarantees having a third party involved is one of the various distinctions between the indemnity clauses and guarantees.

Are Indemnity Clauses Always Enforceable?

Indemnity clauses are enforceable, as long as the specific loss stated in the clause has occurred. Alongside this, indemnity clauses must be specific in order for a judicial body to interpret and enforce the consequences of the loss if litigation is required.

How Do I Draft an Indemnity Clause?

Yes. You are able to negotiate an indemnity clause in your contract, however, it is highly suggested you speak to an experienced lawyer to negotiate the scope of an indemnity that you are involved in. Reach out to our lawyers here at Lawpath who can assist in negotiating an indemnity clause to ensure your interests are protected to the best capacity.