Connor is a legal intern at Lawpath. He has a double degree in Law and Business from UTS. Connor is interested in how technology can disrupt and change professional services to make them more accessible to small businesses.

Sitting on 32 weeks of unused annual leave? You’re not alone! Yes, you can cash out annual leave, BUT only if you pass strict eligibility checks.

To be eligible, you must:

- Keep at least 4 weeks of annual leave after cashing out.

- Have a written agreement each time you cash out.

- Ensure the payment matches what you’d receive if you took leave.

- Not be pressured to do so by an employer.

However, remember that cashing out may increase your tax bill and impact your superannuation calculations. Always consider the tax implications before making a decision.

To understand the ins and outs of cashing out annual leave in Australia, keep reading this guide.

Table of Contents

Annual leave cash out in Australia

Employees sometimes ‘cash out’ annual leave. This is when an employee receives a payment instead of taking time off work. This leave is paid out when employment ends; however, employees may sometimes still be able to receive extra compensation for untaken leave during employment.

Several legal frameworks guide this process and the specific cash-out leave entitlements. In the next sections, we’ll take a closer look at what these are.

Are you looking to hire an employee?

Use our "Hire an employee" workflow to complete and check off all your legal requirements

National Employment Standards (NES)

The National Employment Standards (NES) outline annual leave for employees. This system covers all employees, except casual workers. It entitles all full-time workers to a minimum of four weeks paid annual leave each year and five weeks to certain shift workers.

Cashing out annual leave is only legal if allowed by a modern award or enterprise agreement. Strict rules apply to prevent exploitation and ensure a minimum four-week leave balance after cashing out.

Fair Work Act leave provisions

The Fair Work Act 2009 provides the key legal framework. The Fair Work Commission website lists awards and agreements that include cashing-out terms.

To protect employees from being forced to work instead of taking deserved rest, the NES prohibits cashing out annual leave without meeting several important rules, like minimum remaining leave entitlements and a written agreement.

Modern awards provisions

Modern awards set out additional terms and conditions for particular industries or occupations. Most modern awards now include detailed cash-out clauses. Typically, they stipulate that:

- A maximum of two weeks’ leave can be cashed out each year.

- A written agreement is required for each transaction.

- Other conditions may apply depending on the specific award.

For example, the Hospitality Industry (General) Award [MA000009] covers workers like chefs, baristas, and waitstaff in cafes, restaurants, and hotels, setting out minimum wage, leave, penalty rates, and rules about cashing out annual leave.

Enterprise agreements

Enterprise agreements are negotiated and registered collective agreements for a workplace. Enterprise agreements can also permit cashing out annual leave:

- Terms must be explicit within the agreement.

- All other legal requirements (like leave balance and written agreements) apply.

For example, a supermarket chain might have an Enterprise Agreement that covers wages, working hours, and leave policies for its employees. It would typically include clauses allowing the cashing out of annual leave (if compliant with legal minimums and voted on by staff).

Award-free employees

For employees who are not covered by an award or agreement, cashing out is only possible through a direct written agreement with the employer.

For example, a company that doesn’t follow modern awards or enterprise agreements would likely have its own Annual Leave Policy that aligns with NES and the Fair Work Act. It will stipulate the rules of cashing out annual leave.

This layered legal framework is designed to ensure employees still receive time off for rest and recovery, while providing some flexibility for those who need to convert leave to cash under clear conditions. Every case must follow these strict requirements to remain lawful.

Get your Casual Employment Agreement now for free.

Hire casual employees in any industry. This Employment Agreement (Casual) is essential when hiring new employees for your business.

Core requirements for cashing out annual leave in Australia

When cashing out annual leave, employees and employers must adhere to four essential “Golden Rules”:

- Minimum 4 weeks must remain

Employees must have at least four weeks of accrued annual leave left after cashing out. This ensures they retain enough leave for rest and recovery.

- Written agreement required each time

Every time annual leave is cashed out, there must be a genuine, separate written agreement between the employer and the employee confirming the arrangement.

- No employer coercion allowed

Employers cannot pressure, force, or coerce employees into cashing out their leave. The decision to cash out must be entirely voluntary.

- Full payment rate (including loading)

Payment for cashed-out leave must equal the employee’s full base pay rate for the period, including any applicable annual leave loading or allowances, ensuring fair compensation.

As an employee, you must protect your interests. Here are some red flags to watch out for when understanding your annual leave rights.

- Exceeding the two-week limit: Most modern awards and agreements limit cashing out to no more than two weeks of annual leave in any 12 months. Exceeding this may breach the rules.

- Lack of documentation: Failing to have written agreements or adequate records of cash outs can lead to legal disputes and penalties.

- Undue pressure: Any hint of employer pressure invalidates the agreement and may invite regulatory consequences.

- Incorrect payment: Paying less than the full leave rate, including loading, breaches workplace laws and can trigger claims or penalties.

Following these core legal requirements is critical to ensure compliance and protect the rights of both employees and employers.

Step-by-step process guide to cashing out annual leave

Are you ready to cash in on your annual leave? Here is the process to do so compliantly.

1. Check eligibility (Award/Agreement)

Verify that your award or enterprise agreement permits cashing out annual leave. If you are an award- or agreement-free employee, ensure that you can obtain a written individual agreement.

2. Calculate available leave

Confirm that you have more than 4 weeks of accrued annual leave. After cashing out, at least 4 weeks of leave must remain.

3. Complete a written agreement

Have your employer prepare a written agreement for each cash-out transaction. Both you and your employer must sign. If you are under 18, a guardian’s signature is also required.

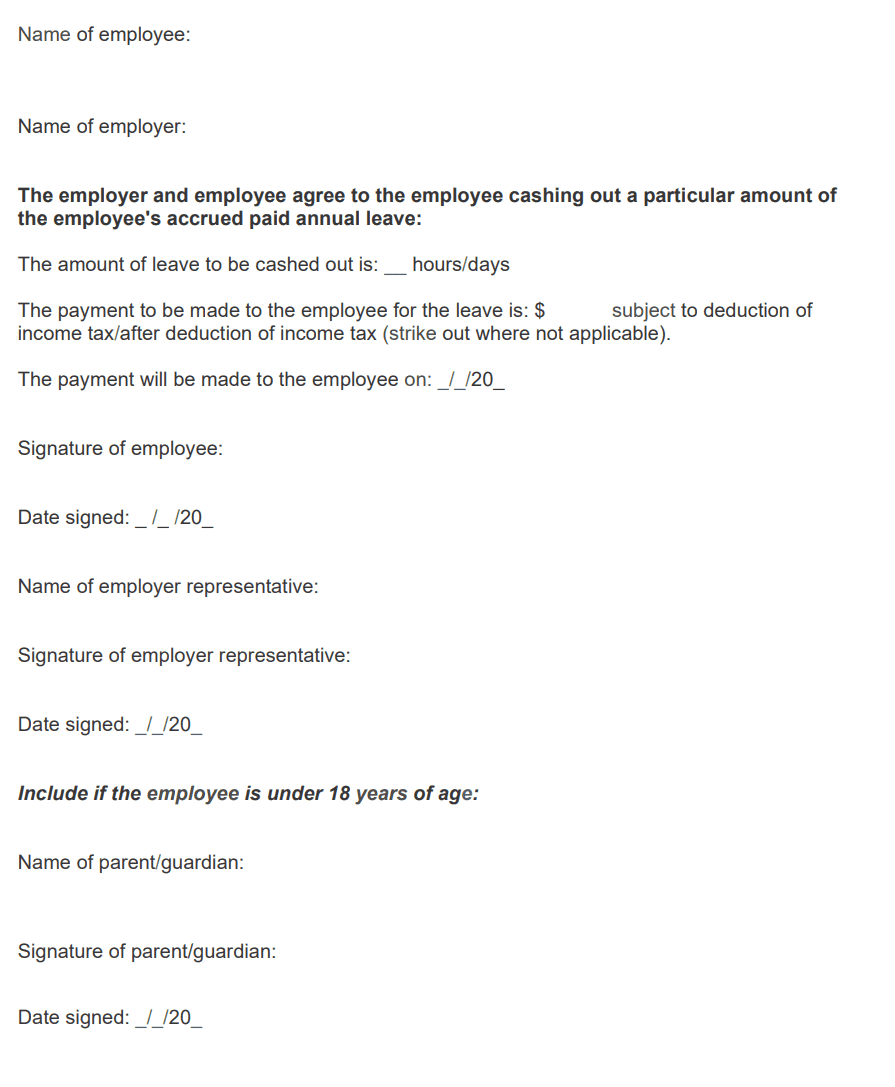

Here is what the Annual Leave Cash Out Agreement Template (Fair Work) looks like:

4. Process payment correctly

Make sure that your employer pays you the equivalent of what you would earn if taking the leave, including any applicable loading and superannuation contributions.

5. Update leave records

Verify that your employer has accurately deducted the cashed-out leave from your leave balance in both payroll and HR systems.

Get your Full Time Employment Agreement legal document for free.

Employer compliance guide: Cashing out annual leave

The above checklist serves employees, but employers will also need to follow specific steps.

1. Prepare relevant documents

Employers must prepare and keep a written agreement for each cashing-out transaction. This agreement must:

- Specify the amount of leave being cashed out

- Include the payment amount and date

- Be signed by both employer and employee

- For employees under 18, a parent or guardian’s signature is also required

2. Set up the payroll system

Configure payroll to:

- Calculate the payment correctly at the employee’s normal pay rate, including any applicable leave loading.

- Deduct cashed-out leave hours/days from the accrued leave balance.

- Calculate and apply Superannuation Guarantee contributions on cashed-out amounts.

3. Keep thorough records

Employers must maintain:

- Copies of all written cash-out agreements

- Payroll records indicating cashed-out leave payments and balances

- Documentation to demonstrate compliance with the minimum 4-week leave balance rule

4. Calculate leave loading

If employees are entitled to leave loading under an award or agreement, the cash-out payment must include the applicable loading, calculated according to ordinary pay rates.

5. Manage PAYG withholding

Employers must withhold tax at the correct rates:

- Use Schedule 5 tax table rates for cashing out leave payments during employment.

- Ensure PAYG withholding reflects the grossed-up amount and remit accordingly.

6. Submit STP

- Report cash out leave payments through Single Touch Payroll (STP) as part of regular payroll reporting.

- Include payment details in employee payment summaries to maintain transparent tax reporting.

Adhering to these compliance steps helps avoid legal issues and auditing risks, ensuring fair and transparent leave management for both employees and employers.

Tax implications for cashing out annual leave in Australia

While it might be tempting to convert annual leave to cash, don’t forget that there are significant tax implications.

Annual leave cash-out tax is distinct from regular income tax. The Australian Taxation Office (ATO) applies Schedule 5 “gross up” rates, which can reach up to 47%, depending on the amount cashed out. This higher rate reflects that the payment is treated like an Employment Termination Payment (ETP), even if employment hasn’t ended.

Employers must report cashing out of annual leave payments in the employee’s annual payment summary and comply with PAYG withholding obligations. These payments must be included in Single Touch Payroll (STP) reporting.

This means that cashed-out leave will also increase taxable income for that year. It could push you into a higher tax bracket, resulting in a higher tax rate on that portion of your income.

Comparing tax: cash out vs. taking leave vs. termination

- Cashing out leave: Taxed at Schedule 5 rates, which are usually higher than normal PAYG rates.

- Taking leave: Paid at regular salary rates with standard PAYG tax withholding.

- Termination: Unused annual leave paid on termination is also subject to Schedule 5 tax rates, but may have additional tax offsets.

| Aspect | Cash Out Annual Leave | Taking Leave | Termination Payout |

| Tax Implications | Taxed at Schedule 5 rates (up to 47%), higher than normal PAYG withholding. | Taxed at normal PAYG rates based on regular income. | Taxed at Schedule 5 rates on unused leave paid at termination; may have offsets. |

| Super Contributions | Super payable on cashed-out leave as ordinary time earnings (OTE). | Super paid as normal on earnings during leave. | No super payable on unused leave paid on termination. |

| Leave Accrual Impact | Leave balance reduced by the cashed-out amount; a minimum of 4 weeks’ leave must remain. | Leave balance is reduced by the duration of leave taken. | No further leave accrued; unused leave paid out. |

| Financial Outcomes | An immediate lump sum payment could push the employee into a higher tax bracket, reducing the net benefit. | Paid as normal wages during leave; maintains leave entitlements steady. | Lump sum paid upon leaving employment; may include annual leave loading. |

You can estimate tax payable on cashed-out leave using the ATO’s PAYG withholding calculators and Schedule 5 tax tables.

Tips for compliant taxation

- Plan your leave cash out strategically to avoid unnecessary tax hikes in a single year.

- Use tax calculators in advance to estimate your net payment after tax.

- Review your overall income to understand if cashing out might push you into a higher bracket.

- Maintain accurate records and ensure your employer applies the correct withholding tax.

Make sure to consult a tax accountant if you aren’t sure how cashing out annual leave may impact your income for the year.

Get a free legal document when you sign up to Lawpath

Sign up for one of our legal plans or get started for free today.

Impact on superannuation

When an employee cashes out annual leave during employment, the amount cashed out is included in their ordinary time earnings (OTE). This means that employers must pay Superannuation Guarantee Contributions (SG) on this amount, just like any regular wages.

The super rate for 2025 increased to 12% in July of this year. This means that if an employee cashes out $2,000 worth of annual leave:

- Super payable = $2,000 x 12% = $240

The only exception applies to leave paid out upon termination of employment — this is not considered part of ordinary time earnings for superannuation purposes.

Award-specific information: cashing out annual leave provisions

Depending on the type of modern award under which your employment falls, the rules for processing annual leave cash-out may differ. Here is a breakdown of the rules for major award categories.

| Major Award | Specific Cash Out Provisions | Sector-Specific Example |

| Clerks Award | Up to 2 weeks of annual leave can be cashed out per year, must have a 4-week balance after cash out, and a written agreement is required. | Office administration staff can request cash out of up to 2 weeks per year under these conditions. |

| Retail Award | Allows cashing out a maximum of 2 weeks annually, with a minimum of 4 weeks’ leave required. The cash-out must be documented and voluntary. | Retail sales assistants may cash out or leave, especially during quieter trading periods. |

| Hospitality Award | Permits cashing out a maximum of 2 weeks’ annual leave; a written agreement is required each time, with a minimum of 4 weeks’ leave retained. | Café and restaurant staff often utilize cash out for financial flexibility. |

| Building/Construction Award | Employees can only cash out up to 2 weeks of annual leave per year, with a 4-week leave balance remaining; a written agreement is mandatory. | Construction labourers may cash out leave between project assignments for additional pay. |

Employees and employers can identify the relevant award and its terms using the Fair Work Ombudsman’s tool.

Special circumstances for cashing out annual leave

There are also several categories of employees that face special rules when it comes to annual leave and cash-out policies.

Under 18 employees

Employees under 18 years of age must obtain written consent from a parent or guardian for each cash-out agreement. This protects younger workers and ensures informed decision-making.

Shift workers (5 weeks leave)

Shift workers entitled to 5 weeks of annual leave under the NES must also retain at least 5 weeks of accrued leave after cashing out. The same cash-out rules apply, but with a higher minimum balance due to their extended leave entitlement.

Part-time employees

Part-time employees accrue and cash out leave on a pro-rata basis relative to their hours worked. They must also maintain the minimum leave balance (usually 4 weeks) prorated to their employment.

Casual employees (not eligible)

Casual employees are generally not eligible to cash out annual leave because they do not accrue paid annual leave under the NES.

Financial hardship provisions

Some awards or agreements provide for cashing out leave in cases of financial hardship, but standard rules still apply (minimum leave balances, written agreement, no coercion).

Excessive leave management

Employers may request that employees with excessive leave balances take leave for health and safety reasons, but cannot force them to cash out. Provisions vary by award and agreement; please refer to the relevant documentation for specific details.

Alternative options for managing annual leave and work arrangements

If you are worried about the tax implications of cashing out your annual leave, there are some alternatives.

Take leave at half pay

You can take your annual leave at half pay, effectively doubling the duration of time off without reducing the total leave balance. This can provide extended rest periods while managing leave balances more flexibly.

Arrange for 4-day work weeks

The 4-day work week is gaining traction in Australia as a way to improve productivity and work-life balance. Work fewer days for the same pay, helping to reduce burnout while maintaining output. This can reduce the need for cashing out leave by spreading out rest periods.

Use time-off-in-lieu conversions

Time-off-in-lieu (TOIL) allows employees to convert overtime hours worked into equivalent paid leave rather than receiving immediate cash payments. Unlike annual leave, TOIL offers a way to bank extra hours for later use without reducing annual leave entitlements.

Transition to retirement strategies

Flexible working arrangements and phased retirement plans allow employees approaching retirement to adjust their hours or days worked, potentially using leave more strategically to ease the transition.

These alternatives provide varied ways to manage leave and work-life balance, reducing pressure to cash out leave and supporting sustainable workforce wellbeing and productivity.

Get on demand legal advice for one low monthly fee.

Sign up to our Legal Advice Plan and access professional legal advice whenever you need it.

Common mistakes in cashing out annual leave

Both employers and employees need to ensure compliance with cash-out rules. Here are some key mistakes to avoid.

- Not maintaining the 4-week minimum leave balance: Failing to keep at least four weeks of accrued annual leave after cashing out is a breach of NES and Fair Work Act rules.

- Missing written agreements for each cash out: Not having a signed written agreement for each cash out transaction violates legal requirements.

- Incorrect tax treatment: Applying standard PAYG rates instead of Schedule 5 taxing rates on cashed-out leave amounts causes non-compliance.

- No superannuation contributions: Failing to calculate and pay super on cashed-out leave (where applicable) breaches super guarantee obligations.

- Exceeding annual cash-out limits: Ignoring award or agreement limits that typically restrict cashing out to a maximum of two weeks per year.

Avoiding these common pitfalls requires strict adherence to rules, thorough record-keeping, and clear communication with employees to ensure compliant and fair cash-out processes.

FAQ

Do you get pay more tax for cashing out annual leave?

Yes, cashed-out annual leave is generally taxed at higher Schedule 5 rates (up to 47%) compared to normal PAYG tax rates.

Am I allowed to cash out my annual leave?

Yes, but only if your award, enterprise agreement, or a written agreement with your employer allows it. You also need to have at least 4 weeks of leave remaining to be eligible.

Can an employer refuse to pay out annual leave?

Yes, if cashing out is not permitted under the relevant award or agreement, or if minimum leave balance rules are not met, an employer can refuse.

Is it better to take leave or cash out?

Taking leave provides rest and recovery and is taxed at normal rates, while cashing out provides immediate pay but is taxed more heavily and reduces your leave balance. Ultimately, the decision is up to you and your employer.

Manage your leave your way

Cashing out annual leave can provide financial flexibility, but it involves strict legal and tax rules that employers and employees must carefully follow. To manage this process smoothly and compliantly, it’s essential to use proper documentation and agreements.

For practical support, check out Lawpath’s reliable, easy-to-use legal document templates. These templates help you save time, reduce errors, and ensure compliance with Australian employment laws.

Get a fixed-fee quote from Australia's largest lawyer marketplace.