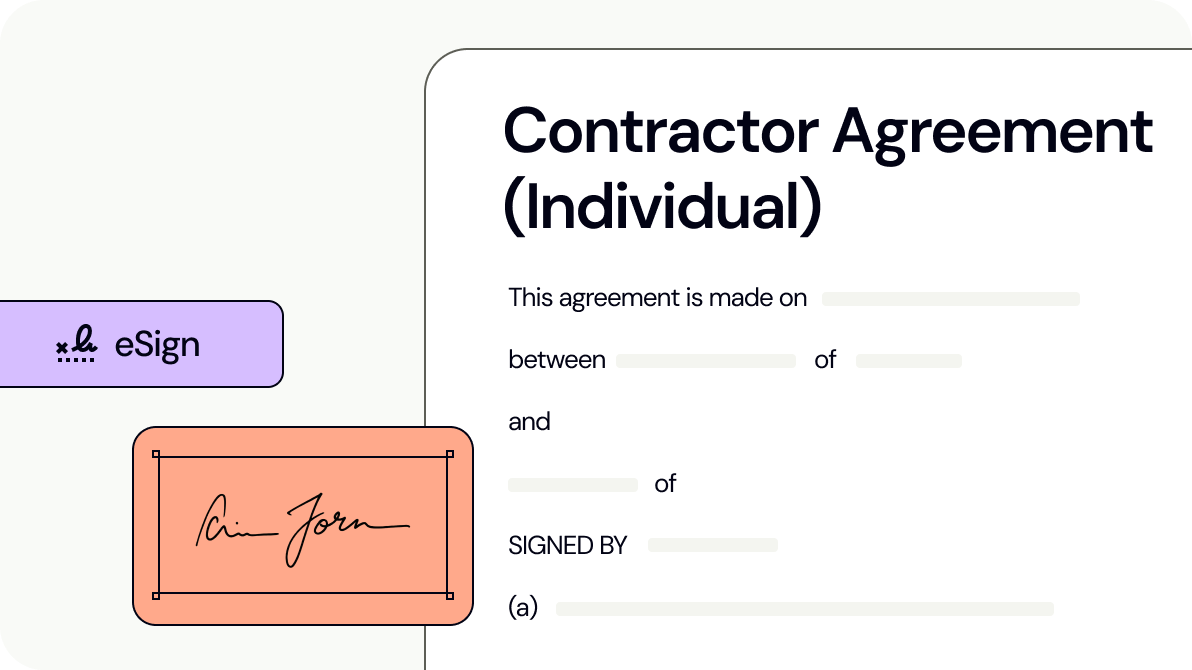

Contractor Agreement (Individual)

The Contractor Agreement (Individual) allows you to hire a contractor that is an individual (ie. not a company).

Last updated October 23, 2025

Suitable for Australia

Create & Customise Legal Templates Online

What is a contractor agreement (individual)?

What is a contractor agreement (individual)?

When should you use a contractor agreement (individual)?

When should you use a contractor agreement (individual)?

What should be in a contractor agreement (individual)?

What should be in a contractor agreement (individual)?

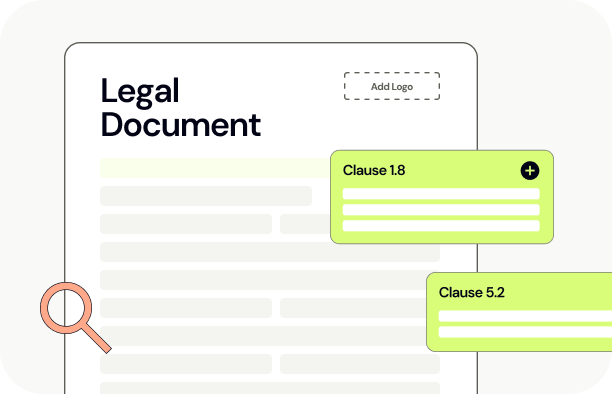

How to create a legal document

- check_circle

Access the Document Library

- check_circle

Select the template that matches your needs

- check_circle

Customise by adding or removing clauses with assistance from Lawpath AI

- check_circle

Personalise with your headers, footers, logos, or additional text

- check_circle

Store all documents securely in your account for easy access

Frequently asked questions

How does this agreement protect my business’s intellectual property?

keyboard_arrow_upWhat are the main risks of using an individual contractor?

keyboard_arrow_upCan I include non-compete or non-solicitation clauses?

keyboard_arrow_upWhat limitations should I be aware of when hiring a contractor?

keyboard_arrow_upHow can this agreement help avoid legal disputes?

keyboard_arrow_upWhat steps should be taken after signing the agreement?

keyboard_arrow_upIs this agreement valid across all Australian states and territories?

keyboard_arrow_upView Sample Contractor Agreement (Individual)

The Legal Risk Score of a Contractor Agreement (Individual) Template is Low

Our legal team have marked this document as low risk considering:

- The agreement places the responsibility of maintaining confidentiality solely on the contractor, which could pose a risk if sensitive information is inadvertently disclosed without proper safeguards from the company's side.

- The contractor is required to handle all legal compliance and associated costs, which might expose them to unforeseen expenses and liabilities if regulatory requirements change or are interpreted differently.

- The document stipulates that the contractor must perform the services personally unless otherwise agreed in writing, limiting the contractor's flexibility to manage their workload and potentially affecting their ability to take on other projects.

Meet Our Users

Articles about Contractor Agreement (Individual)

Looking for more documents?

Privacy Policy

A Privacy Policy outlines how your business will use, store and collect your customers' information. A Privacy Policy is required by law in certain circumstances.

Loan Agreement

This Loan Agreement can be used by lender when offering a loan to a Borrower.

Non-Disclosure Agreement (Mutual)

A Non-Disclosure Agreement (Mutual) allows you and another party to share confidential information while legally forbidding either party from disclosing that information to any other person or entity.

Will

A Will is an essential document as part of your estate plan. This Will cannot be e-signed.

Non-Disclosure Agreement (One Way)

A Non-Disclosure Agreement (One Way) allows you and another party to share confidential information while legally forbidding the other party from disclosing that information to any other person or entity.

Website Terms and Conditions of Use (Services)

This Website Terms and Conditions of Use (Services) document is specifically tailored for websites selling services.

Employment Agreement (Casual)

This Employment Agreement (Casual) is suitable for casual employees in any industry. This agreement is essential when hiring new casual employees for your business.

Business Sale Agreement

A Business Sale Agreement is used to clearly set out all relevant terms of the sale when selling or buying a business.