If you’re selling or buying company shares, your share sale contract is essential. Learn about the ins and outs of share sales here.

Selling your shares or looking to buy shares in a company? If you are, then this guide is for you!

Maybe you’re selling to make a profit or you’d simply like to move on to your next business venture.

Perhaps you’d like to make your first jump into the business game and you’ve decided that buying company shares is the way to go.

Regardless of whether you’re buying or selling, it’s a pretty exciting step to take.

However, we know it can seem a little complicated at times. So, we’re here to make things a little easier.

Our guide lays out what a share sale is, and what it means for you. We also break down the important aspects of a share sale contract and even provide you with a template to help get your drafting process underway.

Let’s jump into it.

What is a share sale?

As its name suggests, a share sale is the sale of a companies shares. This happens when a current shareholder sells the shares they own to a buyer in a bid to make some money or profit.

After a share sale is complete, the buyer of the shares will then have a stake in your company as an owner, commonly known as a shareholder.

Of course, their percentage of ownership directly correlates with the portion or number of shares the new buyer purchases.

For instance, if a buyer purchases 100% of a companies shares, they will become the sole owner of the company. However, if a buyer only purchases 10% of the company shares, they’ll be one of many company owners or shareholders.

In other words, the buyer of shares in a share sale will become a new shareholder.

Of course, not every type of business will be able to have a share sale. Only businesses that operate under a company structure are capable of selling off their shares or, having a share sale.

Therefore, if you operate your business as a sole proprietor, or under a partnership, a share sale won’t be for you. However, you have the option to engage in other types of sales, such as a business sale or asset sale.

If you do decide to engage in a share sale, it’s your responsibility to ensure your contract is properly and clearly written.

But don’t worry, you’re not alone in writing up this contract. Our lawyers are here to help.

In the following paragraphs, we highlight the importance of a well-drafted share sale contract, as well as point you towards to main considerations to look for.

Get a free legal document when you sign up to Lawpath

Sign up for one of our legal plans or get started for free today.

Do I need a share sale contract?

Regardless of whether you’re selling your own shares, or looking to buy, a clearly written share sale agreement is a must.

Generally speaking, having your share sale contract in writing means that both the seller and buyer have come to a full understanding regarding all aspects of the sale.

It provides clarity, certainty and can be a source of protection where warranties and indemnities are spoken about during the negotiation stage.

All in all, the share sale contract stands as written evidence of the sale. Without one, things can get a little messy, especially if a dispute arises regarding the terms of the sale.

Customise and download your first document with us for free

Create, eSign & download 300+ important legal & business documents on our platform.

What are some main considerations when creating a share sale agreement?

1. Shares details

As part of the negotiation stage, you will probably reach an agreement on the share sale price and the number of shares you will be purchasing. It is important to ensure these numbers are correct and accurate within your agreement. It seems pretty simple, but when the share details are written accurately, future misunderstandings and possible disputes are more likely to be avoided.

2. Title, property and risk

Knowing when title, property and risk pass from the seller to the purchaser is important in determining who will be liable if any legal contraventions arise. It is important that both parties understand this clearly, and it is provided for in the share sale agreement. It is quite common for the buyer to inherit all the risks and liabilities attached to becoming a new company shareholder. Because it this, it is wise for buyers to properly research the companies past and current activities, profits and losses. This is also commonly called conducting due diligence. It may seem time-consuming, but as a buyer, you’re taking a big risk if you are negligent in properly researching the company you’re buying into.

3. Rights and obligations

The seller and purchaser should know their rights and obligations regarding the share sale pre-, during, and post-completion. For example, the purchaser would expect the vendor to manage and conduct the business with care and maintain the profitability and value of the business. On completion, the seller should hand over and complete relevant documentation to give full effect to the sale.

4. Confidentiality

During the share sale process, sensitive information will no doubt be shared between the parties. A confidentiality clause ensures that this information stays between the parties.

5. Warrenties

Warranties given by the seller to the buyer are often extremely important to the success of any share sale.

6. Indemnity

To prevent disputes about certain circumstances, the seller should be willing to indemnify or reimburse the purchaser. When it comes to share sale contracts, the indemnity clause is basically a promise by the seller to compensate the buyer for any loss or damage they might suffer at the hands of some third party. Therefore, for the share purchaser, an indemnity clause is almost a ‘make or break’ type of situation, so it should be in your agreement.

7. Restraint

If you are purchasing a substantial share of a business, you would not want the seller to set up a similar business near you and solicit customers and/or suppliers, among other things. Placing types of business, area, and duration restraints on the seller ensures that your newly acquired business can prosper without the added concerns of monitoring the seller.

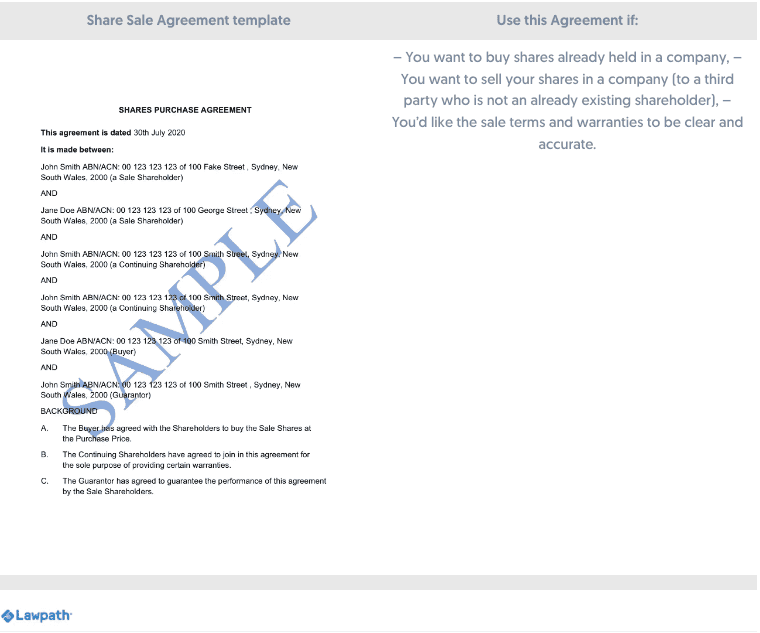

A share sale contract template to help you get started

Need a share sale contract? We’ve got you covered. Our team of lawyers have created a top tier template for you to work from to help get your share sale underway. So, if you’re wanting to sell your shares or looking to buy, you’ll need a Share Purchase Agreement. Your share purchase agreement, or share sale contract, will help you layout everything in writing, giving both parties clarity and certainty. In general, your share purchase agreement should include:

- The name(s) of the seller(s) and buyer,

- Amount of shares being sold,

- Price of the shares,

- Terms and conditions surrounding waivers, relinquishment of control etc,

- Warrenties.

Below, we’ve provided you with a brief snippet of our Share Purchase Agreement template, as well as outlined exactly when to use it.

Burning questions about share sales

We’ve got the answers to some burning questions surrounding share sale contracts, also commonly known as share purchase agreements. Read on below.

Is a share sale contract legally binding?

Generally, yes. A share sale contract will be a legally binding contract if all the elements to create a legally binding document are present. So, how do you know whether you’ve created a legally binding document? Well, you must ensure that the 5 following elements are present:

- Offer and acceptance,

- Consideration,

- Certainty in the terms,

- Legal capacity and,

- Intention to create legal relations.

If they aren’t present within your share sale contract, then it’s possible your contract may not be seen as legally binding. It’s always best to speak to one of our lawyers if you find yourself questioning the legal standing of contracts and agreements.

Who are the parties to a share sale contract?

Put simply, the parties to the share sale contract are the:

- Seller of the shares and,

- Buyer of the shares.

It’s also quite common for the continuing owner(s) of the shares to join into the share sale contract to provide certain warranties about the transaction. These warranties may be that the transaction between the seller and buyer are true, complete and accurate.

What other documents do I need when buying/selling my shares?

As addressed in this guide, you’ll need a well-drafted share sale or share purchase agreement when you’re buying or selling shares. But, do you need to look at any other documents? In short – YES. As you are buying or selling shares in a company, you’ll need to review a few documents that relate to companies shareholders and the transfer of shares. In actual fact, there are a few documents you’ll need to review to ensure the change over of shares has been correctly recorded and administered. As such, it’s best practice to review and make appropriate changes to the following documents:

- Share transfer form: The transfer form is as an official record. Transfer form must be lodged with ASIC within 28 days of the share transfer date,

- Share certificate: Document outlining the updated allocation of shares to each shareholder,

- Shareholders agreement: As the buyer will become a new shareholder, the shareholders agreement should be updated,

- Shareholder accession deed: A deed used to add a new shareholder onto an existing sharholders agreement,

- Company constitution (if applicable): Must be reviewed and understood by new shareholder,

- Directors resolution: If the buyer will become a director, or if the seller was a director, these updates must be reflected.

Do I have to pay capital gains tax (CGT) on the shares I have sold?

Basically, capital gains tax or CGT is the amount of tax you need to pay on any profits you’ve gained from selling any of your assets. These assets do include any shares you own in a company. How do you calculate the profits the CGT will apply to? So, if you originally purchased your shares for one price, but have sold them at a higher price, the difference between those amounts will be the ‘profits’ you pay capital gains tax on. Now, the amount of tax you’ll need to pay depends on a few things. For instance, if you’ve held your shares for at least 12 months, you’ll be eligible to reduce your share profits CGT by 50%.

Key takeaways

No matter whether you’re selling or buying company shares, a share sale contract is of vital importance. It will stand as the crux of your negotiations and agreement, making the transfer process smooth and successful. For the purchaser, buying company shares is a big move. So, you’ll need to ensure you have conducted a thorough background check on the company. It’s important to negotiate with the seller regarding your agreements specific warranty clauses and indemnity clauses. For the seller, you must ensure the contract is well-drafted and not misleading in any way, as drafting an incorrect or inaccurate share sale contract could give rise to a dispute against you.

Contact us on 1800 529 728 to learn more about customising legal documents, obtaining a fixed-fee quote from our network of 600+ expert lawyers or to get answers to your legal questions.

Get a fixed-fee quote from Australia's largest lawyer marketplace.