As a freelancer or consultant in Australia, you need clear legal safeguards to protect your work, income, and intellectual property. However, navigating the complexities of contracts, confidentiality, and payment terms without proper legal documents can lead to disputes, delayed payments, or loss of rights.

In this article, we explore the essential legal documents every freelancer and consultant should have, explain why these documents matter, and show how platforms like Lawpath can simplify legal processes, saving time and money.

Table of Contents

Why legal documents are essential for freelancers and consultants

If you are a freelancer or consultant in Australia, you are joining the ranks of an increasing number of professionals who are choosing flexible, independent work arrangements. However, this growth comes with risks such as non-payment, disputes over deliverables, and intellectual property (IP) theft. Without clear legal agreements, you can find yourself vulnerable to clients who delay payment or misuse your work.

Australian freelance legal documents serve as a protective framework that defines expectations, responsibilities, and remedies, reducing the chance of costly conflicts. They also enhance professionalism and credibility, which is vital in competitive markets. Ultimately, it’s essential both to protect and promote your business.

Key legal documents every freelancer should have

Key documents provide legal protection for freelancers and consultants. Each document serves a specific purpose and helps avoid common pitfalls that can lead to disputes or financial loss.

Below, we break down the essential legal documents you need, what each should include, and key issues to avoid to ensure your freelance business runs smoothly and securely. Plus, Lawpath provides a comprehensive range of freelance contract templates so you can protect your business.

Customer Testimonial: Carina Gonzales, Founder of Cheeky

“I engaged in lots of different contract, I needed to prepare to start up my online business, from terms and conditions to shipping terms. I have always had someone from the Lawpath team alongside, guiding me and making my clients and my business feel protected.

Freelance contract or independent contractor agreement

A professional contract is the foundation of your professional relationship with clients. It sets clear expectations and protects both you and your clients by outlining the terms of engagement.

A well-drafted contractor agreement should include the following details.

- Scope of work: Detailed description of services you will provide.

- Compensation: Exact payment amount, currency, and schedule (e.g., “within two weeks of submission”).

- Deadlines and timelines: Clear project milestones and delivery dates.

- Responsibilities: Roles and obligations of both freelancer and client.

- Confidentiality and IP ownership: Clauses specifying who owns intellectual property rights and confidentiality obligations.

- Termination clause: Conditions under which either party can end the contract.

- Communication: Preferred channels and frequency of communication.

- Governing law: Jurisdiction and legal framework governing the contract.

- Breach remedies: Steps to take if either party breaches the agreement.

Having a signed freelance contract ensures both parties agree on what services will be delivered and under what conditions, which helps prevent misunderstandings and disputes. It also protects you if a client tries to change terms mid-project or refuses to pay.

Non-disclosure agreement (NDA)

A non-disclosure agreement (NDA) protects confidential information shared between you and your client. Freelancers often handle sensitive data, proprietary processes, or trade secrets that clients want to keep private. NDAs legally bind both parties to confidentiality, preventing unauthorised disclosure.

An NDA should include:

- Definition of confidential information: Precisely what information is protected.

- Duration: How long the confidentiality obligation lasts.

- Obligations: Duties of the receiving party to protect the information.

- Permitted disclosures: Exceptions such as disclosures required by law.

- Penalties: Consequences of breaching the agreement.

Common scenarios for NDAs include working on new product designs, marketing strategies, or software development projects. Using an NDA builds trust and ensures you won’t be legally liable if confidential information is leaked.

Licencing agreement (IP)

Intellectual property (IP) can be one of the most valuable assets you create during a project—and also one of the most contested. A clearly worded IP Licensing Agreement ensures there’s no confusion over who owns the rights and how the work can be used after the project ends.

Unlike an IP Assignment, which permanently transfers ownership of the IP to another party, an IP Licensing Agreement allows you (the licensor) to retain ownership while granting another party (the licensee) the right to use your IP—on terms that you control.

This agreement typically covers:

- Ownership: Clarifies that you retain IP rights as the creator.

- Scope of licence: Outlines how the IP can be used (e.g. commercial use, time limits, exclusivity).

- Types of IP: Specifies whether the licence applies to copyrights, trademarks, patents, trade secrets, or other protected work.

- Moral rights: Confirms any non-economic rights you retain, such as attribution or protection from derogatory treatment.

- Confidentiality: Safeguards sensitive or proprietary information shared during the engagement.

- Licence fees and termination: Sets out how you’ll be compensated and under what conditions the licence can be revoked.

Many freelancers and small businesses unknowingly sign away their rights or end up in costly disputes due to vague IP terms. A strong IP Licensing Agreement protects your work, ensures proper credit, and provides clarity on how your IP can—and can’t—be used.

Terms of service and privacy policy (for freelance businesses with a website)

If you operate a website offering services, products, or online courses, these documents are vital.

Website terms and conditions of use set the rules for using your website and services, limiting your liability and outlining user responsibilities. They should include:

- Rules for using your site and services

- Limitations of liability

- User responsibilities and prohibited conduct

- Payment and refund policies

A privacy policy is legally required if you collect personal data such as emails or payment information. It explains how you handle, store, and protect user data, ensuring compliance with Australian privacy laws and building customer trust. This document should include:

- Types of personal information collected (e.g., names, emails)

- How information is collected, used, stored, and protected

- Disclosure to third parties, if any

- User rights regarding their data

- Contact information for privacy concerns

Invoice and payment terms document

Invoices in Australia must include specific details like your Australian Business Number (ABN), contact info, payment terms, and Goods and Services Tax (GST) if applicable.

You can use a freelancer invoice template that complies with Australian law as the base for all of your transactions. This document should include:

- A statement that it is a tax invoice

- Your business name and ABN

- Date of issue

- Description of goods or services provided

- Price and GST amount, if applicable

- Payment terms and due date

- Buyer’s identity or ABN for sales over $1,000

Additionally, a formal Services Agreement or clause in your contract should specify due dates, late payment fees, and methods of payment. This helps maintain a steady cash flow and provides legal backing if payments are delayed or disputed.

Specify the following:

- Payment methods accepted

- Due date

- Late payment fees or interest charges

- Consequences of non-payment

Clear invoicing reduces confusion and speeds up collections.

Letter of demand

A letter of demand is a formal notice sent to clients who have not paid invoices on time.

What it should include:

- Address and introduction identifying the recipient and purpose

- Summary of the contract or agreement and outstanding payment

- Description of the breach (non-payment)

- Legal basis for the demand, referencing relevant laws or contract clauses

- Specific demand for payment and deadline

- Statement of intent to take legal action if unpaid

Lawpath offers three tailored letters of demand templates to suit different situations:

This document often prompts payment without needing court proceedings. It also makes it clear that you have attempted to resolve the situation amicably, in case the process escalates.

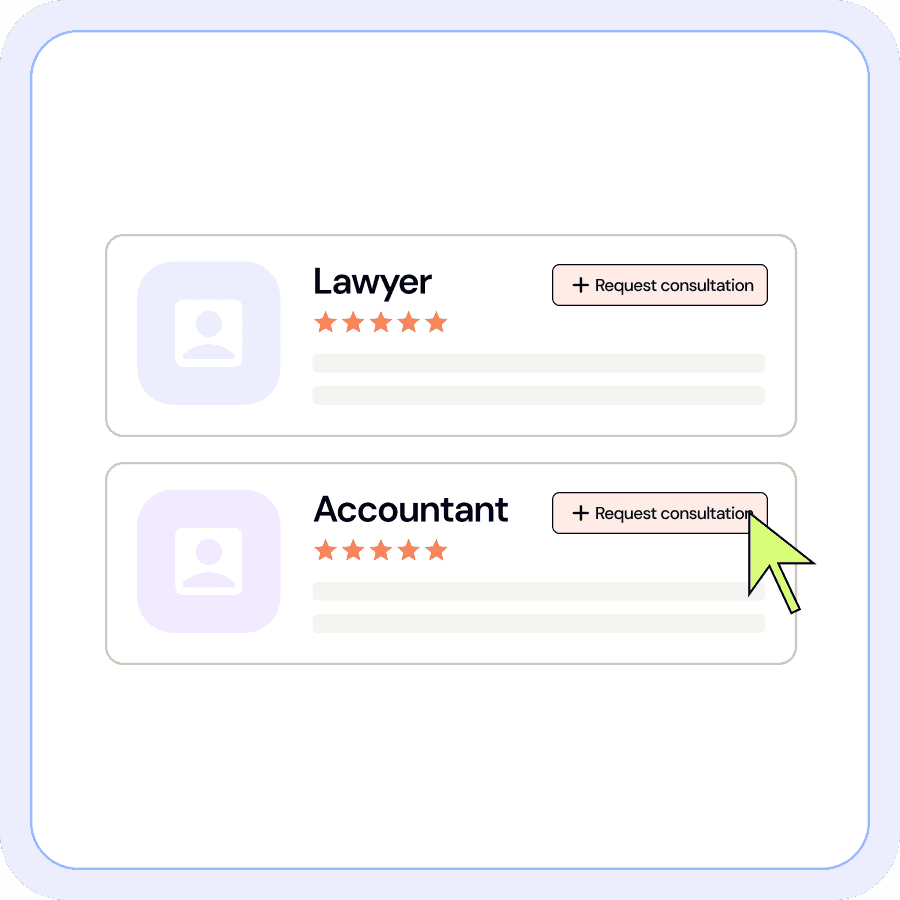

How legal platforms help you streamline the paperwork

Platforms like Lawpath provide a product-led solution that makes creating, managing, and customising legal documents fast and affordable. With access to high-quality, attorney-drafted templates, you can generate contracts, NDAs, IP agreements, and more by answering simple questions online.

You can use Lawpath’s in-browser editor for streamlined customisation and branding, while features like e-signatures and document collaboration.

Additionally, Lawpath offers access to affordable legal advice, helping you stay compliant and confident. This automation saves time, reduces errors, and scales with your business needs.

Customer Testimonial: Jessica Mudditt, Hembury Books

“Lawpath has absolutely been a massive help. It really makes it a lot easier for smaller businesses to get legal help rather than thinking I can only go to a lawyer when I’ve got a heap of money. Having them there to jump on a call literally the next day made a huge difference. That alone, in terms of value, is worth a lot more than the subscription cost.”

Legal tips for Australian freelancers

Freelancing in Australia offers flexibility and independence, but it also means you are responsible for your own legal and financial compliance. Here are essential legal tips to help you out.

Keep your ABN details updated

Your ABN is fundamental for invoicing, tax compliance, and identifying your business in dealings with the Australian Taxation Office (ATO) and clients. If you operate under a business name different from your own, you must also register that name with the Australian Securities & Investments Commission (ASIC).

Keeping your ABN details current is crucial; outdated information can lead to payment delays, missed tax credits, or even withheld payments from clients.

You can update your ABN details online through the Australian Business Register, and it’s wise to review your registration annually to ensure everything is accurate.

Use signed contracts for every gig

Every project, regardless of size, should be governed by a written contract. A signed agreement clarifies the scope of work, payment terms, deadlines, and intellectual property rights, significantly reducing the risk of disputes or misunderstandings.

Relying on informal agreements or emails leaves you vulnerable if a client refuses to pay or changes the project requirements. Having a robust freelancer agreement protects your interests while enhancing your professionalism and credibility with clients.

Understand superannuation obligations

Superannuation can be complex for freelancers. If you are self-employed as a sole trader, you are generally responsible for making your own super contributions, although these are not compulsory. However, if you’re working under certain contract arrangements, you may be eligible for employer-paid superannuation, depending on the nature of your engagement and the contract terms.

The ATO provides help and guidelines so you can determine your super entitlements and obligations. This prevents you from missing out on retirement savings or breaching compliance requirements.

Maintain clear financial records

Good record-keeping is both a legal requirement and a best practice for freelancers. You must keep invoices, receipts, contracts, and payment records for at least five years, as required by Australian tax law. These records are essential for filing accurate tax returns, claiming tax deductions, and providing evidence in case of an audit.

Financial records should include all business transactions, bank statements, GST documents, and any superannuation contributions. Organised records also help you monitor your business’s financial health and prepare for growth.

Post a privacy policy if collecting personal data

If you collect, store, or use any personal information from clients or website visitors, such as names, emails, or payment details, you are subject to Australia’s Privacy Act. A privacy policy is mandatory for any freelancer with a website or online business that handles personal data.

This policy must clearly state what information you collect, how you use it, how it is stored, and whether it is shared with third parties. Many clients and platforms require proof of a privacy policy before engaging your services, and non-compliance can result in significant penalties.

FAQ

Is a freelance contract legally binding in Australia?

Yes, a freelance contract is legally binding once both parties have agreed and signed it, providing enforceable terms to protect your work and payments.

Can I create freelance legal documents myself?

You can create your own documents by using professionally drafted templates or legal platforms like Lawpath, which ensures your contracts comply with Australian laws and cover all necessary protections.

What happens if I don’t have a legal agreement in place?

Without a legal agreement, you risk non-payment, disputes over work scope, and loss of intellectual property rights, making it difficult to enforce your rights or claim damages.

Protecting your business interests

Legal documents are essential tools that empower Australian freelancers and consultants to protect your work, income, and reputation. By using clear contracts, NDAs, IP agreements, and invoicing terms, you reduce risks and build professional trust.

Platforms like Lawpath simplify this process, offering affordable, customisable legal templates and expert advice tailored to your needs. Don’t leave your freelance business vulnerable. Secure your success with the right legal documents today.