Term Sheet - Seed Investment

A Term Sheet Seed Investment document establishes the general terms of an investor joining your business.

Last updated February 3, 2025

Suitable for Australia

Create & Customise Legal Templates Online

What is a term sheet - seed investment?

What is a term sheet - seed investment?

When should you use a term sheet - seed investment?

When should you use a term sheet - seed investment?

What should be in a term sheet - seed investment?

What should be in a term sheet - seed investment?

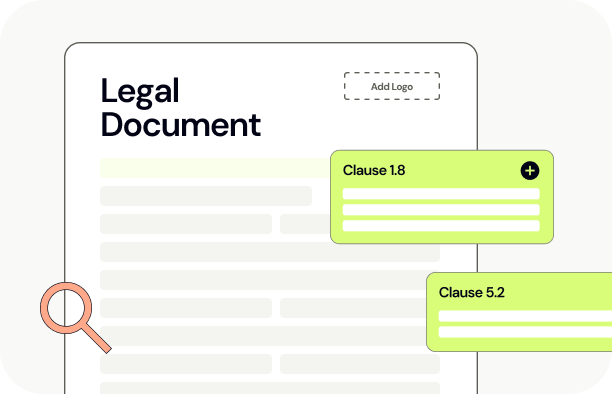

How to create a legal document

- check_circle

Access the Document Library

- check_circle

Select the template that matches your needs

- check_circle

Customise by adding or removing clauses with assistance from Lawpath AI

- check_circle

Personalise with your headers, footers, logos, or additional text

- check_circle

Store all documents securely in your account for easy access

Frequently asked questions

What protections does this document offer to my startup?

keyboard_arrow_upAre the terms in this document legally binding?

keyboard_arrow_upWhat are the main limitations of using this term sheet?

keyboard_arrow_upHow does this document address due diligence?

keyboard_arrow_upWhat happens if the deal does not proceed after signing?

keyboard_arrow_upDoes this document cover all Australian states and territories?

keyboard_arrow_upWhat are the next steps after signing the term sheet?

keyboard_arrow_upView Sample Term Sheet - Seed Investment

The Legal Risk Score of a Term Sheet - Seed Investment Template is Medium

Our legal team have marked this document as low risk considering:

- The document allows the investor a period to conduct further due diligence and potentially withdraw from the transaction, which could leave the company in a position of uncertainty and potential loss of other opportunities during this period.

- The exclusivity clause restricts the company from engaging with other potential investors or entertaining other proposals for a specified timeframe, which might limit the company's opportunities to secure possibly better or more immediate investments.

- The costs clause specifies that the company bears all of the investor’s third-party expenses related to the transaction up to a certain limit, which could result in unforeseen financial burden on the company if these costs exceed initial estimates.

Assuming users have a basic understanding of such agreements, the risks are typical of investment negotiations and can be managed with careful planning and legal guidance.and risk as the efforts of both parties might not result in a secured contract.

Meet Our Users

Articles about Term Sheet - Seed Investment

Looking for more documents?

Non-Disclosure Agreement (Mutual)

A Non-Disclosure Agreement (Mutual) allows you and another party to share confidential information while legally forbidding either party from disclosing that information to any other person or entity.

Will

A Will is an essential document as part of your estate plan. This Will cannot be e-signed.

Non-Disclosure Agreement (One Way)

A Non-Disclosure Agreement (One Way) allows you and another party to share confidential information while legally forbidding the other party from disclosing that information to any other person or entity.

Shareholders Agreement

A Shareholders Agreement allows you to clarify the relationship between shareholders of your company.

Memorandum of Understanding (MOU)

A Memorandum of Understanding is a non-legally binding precursor document that allows you to record proposed terms with another party during the negotiation stage.

Confidentiality Agreement (Mutual)

This Confidentiality Agreement (Mutual) allows you and another party to share confidential information while legally forbidding the other party from disclosing that information to any other person or entity.

Partnership Agreement (General)

A Partnership Agreement (General) governs the relationship between all the partners involved in your business.

Commercial Lease Agreement (Non-Retail) (NSW)

A Commercial Lease Agreement (Non-Retail) is a legal document that can be used when a commercial property is being leased out in NSW.