Connor is a legal intern at Lawpath. He has a double degree in Law and Business from UTS. Connor is interested in how technology can disrupt and change professional services to make them more accessible to small businesses.

💡Key Insight

- Turnover rent in a commercial lease means the tenant’s rental payment is tied to their business’s revenue by requiring a percentage of sales on top of a base rent, aligning rental costs with actual trading performance.

- In a typical turnover rent arrangement, the lease will specify a base rent plus a percentage payable on turnover once an agreed threshold is reached, with calculations usually prepared monthly, quarterly, or annually.

- The definition of turnover for turnover rent purposes excludes items like deposits, credit sales, and lay-bys, and may be negotiated to exclude online sales, meaning careful drafting affects how much rent is ultimately payable.

- One benefit of turnover rent is it shares commercial risk between tenant and landlord, reducing pressure on tenants during slow sales periods while giving landlords the potential for higher returns when business performance improves.

What is Turnover rent?

Turnover rent is a way a business can pay for rent to their landlord. Many retail lease agreements will also call this ‘percentage rent’. If you are not sure what kind of lease you have, there are a few important differences between a commercial and retail lease.

Turnover rent is a worked out as a percentage of turnover. The tenant and landlord will agree to the percentage level. For example 10% of turnover. This is also usually a payment in conjunction with base rent.

Base rent is usually the lowest acceptable rental provided in a lease. It refers to the commencing rent, excluding outgoings and is typically indexed to inflation. Turnover rent is a provision within a lease, allowing the landlord to receive a form of rental that is based wholly or partly on the sales turnover of the tenant.

How does it operate?

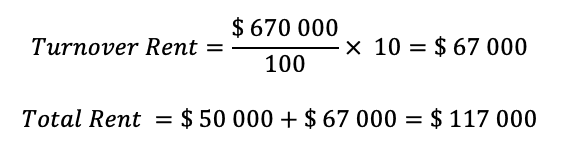

As an example, let’s say a Mens Clothing Store in a mall has agreed to pay a base rent of $ 50 000 plus 10% of turnover. Let’s say the business had a turnover of $ 670 000.

This is only a basic example. An accountant would ordinarily perform these calculations monthly, quarterly or annually and prepared into a statement.

What’s considered Turnover?

Turnover rent and the ways it can be used in a retail lease agreement is limited under current law. For example ‘turnover’ does not include any deposits, credit sales or lay-bys. These exclusions are the minimum standards of what goes into the calculation of ‘turnover’.

A tenant can also propose their own exclusions and terms into the agreement. It is important to know that the minimum exclusions do vary from state to state. A commonly negotiated exclusion from turnover is internet sales. Tenants will try to exclude this sales channel from the calculation because it is not associated to the land or property.

Want more?

Sign up for our newsletter and be the first to find hand-picked articles on topics that we believe are crucial to successfully scale your unique small business.

By clicking on 'Sign up to our newsletter' you are agreeing to the Lawpath Terms & Conditions

Why use Turnover Rent?

Turnover rent is a great business tool to lower the risk and impact of poor trading periods or un-for-seen financial impacts the business may experience. Because the rent received by the landlord is based upon the performance of the business, the landlord now has a shared interest and exposure to the business. The external risk is now shared between the landlord and tenant.

It is the sharing of risk which makes using turnover rent an appealing option for both tenants and landlords. New business ventures are naturally risky because there are many unknowns. An option to minimise risk and it’s impact can be beneficial in some cases.

For landlords or tenants, turnover rent can leave many questions to be asked before a considering a turnover component to their lease. If you are considering a turnover component to a lease agreement book a chat with one of our commercial lawyers.

Get a fixed-fee quote from Australia's largest lawyer marketplace.